Chinese Companies "Penetrate" European Supply Chain

One year after the EU imposed tariffs, Chinese car manufacturers saw a 93% increase in sales in Europe. Market analysis firms project that sales of Chinese car companies in the EU, the UK, and the European Free Trade Association countries are expected to exceed 700,000 units by 2025, significantly surpassing last year's 408,000 units.

This seems to be contrary to the original intention of the EU imposing tariffs on Chinese-made electric vehicles—to provide a buffer space for the domestic automotive industry.

Chinese car manufacturers are making rapid progress in the European market, partly due to timely adjustments in their product structure, increasing the export proportion of plug-in hybrid and extended range products. Additionally, it is related to China's comprehensive and low-cost supply chain system in the new energy sector. Data shows that the overall manufacturing cost of Chinese cars is 20%-30% lower than that of Europe. Based on this, "Made in China + Export" still has significant economic advantages.

The "gold content" of China's new energy vehicle industry chain has been recognized by European car companies and incorporated into their core supply chain systems. The overseas expansion of China's automobile industry is gradually extending from "selling cars" to "manufacturing systems."

Chinese battery suppliers are indispensable.

Power batteries are the most representative entry point in this change. Nowadays, the presence of Chinese battery manufacturers has become indispensable in the electrification process of major European car manufacturers.

According to public data, thanks to long-term accumulation in battery energy density, life management, manufacturing yield, and cost control, CATL has achieved a market share of 40% in the European power battery supply market. Besides CATL, companies like Envision AESC and Gotion High-Tech have also established long-term partnerships with some mainstream European car manufacturers.

The cooperation between the two sides is further deepening through localized investments. In recent years, Chinese power battery companies have noticeably accelerated their layout in Europe due to strategic considerations.

After the stable operation of CATL's factory in Germany, its super factory in Hungary is accelerating construction, with a planned capacity of 100GWh, expected to be put into production in early 2026, covering key automotive industry areas in Central and Eastern Europe, including Germany, the Czech Republic, and Slovakia.

Farasis Energy's factory in Douai, France, has commenced operations in June 2025, primarily supporting the Renault Group; the Sunderland factory in the UK is about to start operations, serving Nissan; the factory in Spain has also been inaugurated.

Image Source: CATL

Guoxuan High-tech's factory in Germany has achieved proximity supply for the Volkswagen Group, and its new project in Slovakia has also been launched, receiving funding support from the local government. Companies such as Zhongchuang Xinhang, Yiwei Lithium Energy, and Xinwandah are also advancing factory construction in countries like Portugal and Hungary.

According to the plan, the aforementioned factory will reach its peak production capacity between 2026 and 2027, forming a battery production capacity network covering Western Europe, Central and Eastern Europe, and Southern Europe. The strategic layout of local production capacity has created a close supply chain binding relationship between Chinese battery companies and European car manufacturers.

Ningde Times not only provides products for multiple multinational automotive companies but has also established a joint venture with Stellantis Group to build a lithium iron phosphate battery factory in Spain. EVE Energy's factory in Hungary is located right next to BMW and will supply exclusive battery products for its "New Generation" models.

The supply relationship established by both parties has had a substantial impact, particularly in accelerating the launch of affordable electric vehicle models in Europe. In the face of stringent carbon emission regulations and a cost-sensitive market, European automakers urgently need to introduce competitive and affordable electric vehicle models while controlling costs. Chinese battery companies, with their mature lithium iron phosphate battery technology and outstanding cost control capabilities, perfectly meet this demand.

For example, the Renault 5 E-Tech is equipped with batteries produced by Envision AESC's factory in France, with battery costs reduced by about 15%, helping its price drop to 25,000 euros, surpassing the Tesla Model Y to become the best-selling B-segment electric vehicle in Europe.

Envision AESC's Douai factory in France, image source: Envision AESC

The advantages of Chinese battery companies are not only reflected in price but also in their overall competitiveness. Chinese battery companies have developed comprehensive capabilities ranging from cell design and system integration to large-scale manufacturing, which are still relatively scarce in Europe.

As the development cycle of electric vehicles continues to shorten, automakers' requirements for battery suppliers are no longer limited to simply delivering products; they now expect participation in vehicle platform development and a shared responsibility for R&D risks. In this regard, the responsiveness and engineering collaboration capabilities of Chinese battery companies are becoming important advantages for them to enter the core supply chain in Europe.

Chinese battery companies' investment in Europe also brings direct economic effects to the local industrial chain. Firstly, it helps European car companies reduce supply chain uncertainties and lessen their reliance on cross-regional logistics. Secondly, it creates job opportunities and promotes the clustering effect of related supporting industries in the local area.

Intelligent networking has also entered the procurement system.

If the power battery lays the hardware foundation for electric vehicles, then intelligent connected technology defines the "soul" and user experience of the car. As the European automotive industry advances from electrification to deeper levels of intelligence, the importance of software, electronic and electrical architecture, and cabin experience is rapidly increasing.

In comparison, intelligent connected vehicles heavily rely on the collaboration between software and hardware, rapid iteration, and an understanding of user experience. Chinese suppliers, who have long been entrenched in the Chinese market and are accustomed to a high-intensity product update rhythm, are gradually showing comparative advantages. In recent years, Chinese intelligent connected vehicle suppliers such as Desay SV, Baidu's Apollo, and Yika Tong have successively entered the product systems of European car manufacturers.

Image source: Yikatong

Taking Yikatong as an example, its smart cockpit and vehicle computing platform have been applied to some models of Smart and Mercedes-Benz. For instance, it provides smart cockpit solutions for multiple models of the Smart EQ series.

This collaboration is quite representative. On one hand, both smart and Mercedes-Benz have very high requirements for product stability and safety, with strict supplier admission standards; on the other hand, Yikaton is not simply providing a single piece of hardware, but is involved in the overall architecture design and integration of the cockpit system.

It is worth noting that the continued collaboration among the three parties is also due to the long-term technical synergy and capital ties between Yikatong and one of its shareholders, Geely Automobile, which owns Mercedes-Benz. In addition, Yikatong has also collaborated with Geely's brands such as Volvo and Lotus in global markets, and its technology output range is continuously expanding. According to data, Yikatong secured over $1 billion in overseas orders in the second quarter of this year.

Desay SV has established factories in multiple locations across Europe to serve customers locally. The German factory has already commenced production operations, while the Spanish factory is expected to be completed by the end of 2025 and will begin supplying a range of intelligent products such as smart cockpits and intelligent driving systems to customers in 2026. The German and Spanish factories primarily serve European clients such as Volkswagen and Volvo.

In the forefront fields of auxiliary driving perception and positioning, Chinese suppliers are accelerating their entry into the sight of European car manufacturers. For example, high-precision positioning technology supplier Duyuan Technology has entered the supply chains of international brands such as Volkswagen, Toyota, and BBA, providing critical positioning data for their advanced driver-assistance systems. LiDAR companies Hesai Technology and Tudatong have also frequently appeared at European industry exhibitions and are collaborating with international autonomous driving companies.

At the same time, some traditional component manufacturers have also expanded their roles amid the wave of intelligence. Taking Zhongding as an example, it has continuously expanded its production bases and R&D capabilities in Europe through a series of overseas investments and acquisitions, focusing on system integration, quality control, and global collaboration, thereby enhancing its global cooperation and supply network.

A similar path is also seen with Baotai Car Connection. In order to more accurately meet the demands of Chinese users for intelligence, Porsche has chosen to co-create with the Chinese smart cockpit supplier Baotai Car Connection.

Image source: Porsche

Both parties are jointly developing a China-exclusive in-car infotainment system for Porsche models, which is planned to be installed in various Porsche models by 2026. Pateo provides full-stack support capabilities from underlying hardware (domain controllers based on Qualcomm chips), middleware software to upper-layer application ecosystems. Although the collaboration is currently limited to the Chinese market, it also demonstrates European car manufacturers' recognition of China's intelligent connectivity capabilities.

European car manufacturers are gradually accepting intelligent connected suppliers from China for two main reasons. On one hand, the increasing intelligence in vehicles is significantly lengthening the technical chain of vehicle development, making it difficult for traditional supply systems to meet the demands for rapid iteration. On the other hand, with intensified market competition, car manufacturers need to control costs while ensuring quality, and Chinese suppliers' advantages in engineering efficiency and large-scale delivery are precisely what fills this gap.

Research and supply chain delivery

After Chinese suppliers gradually entered the core supply system of European car companies, the partnership between the two sides is no longer limited to procurement, but has been upgraded to a bidirectional flow of research and development achievements and supply systems.

This change is first reflected in the product development model of the automotive companies. Taking Renault as an example, during its transition to electrification, it has gradually established a hybrid model of "European design + Chinese supply chain." The concept and styling design of Renault's latest Twingo E-Tech and other planned affordable electric vehicles are led by a French team, while the core tasks of engineering development, supply chain integration, and cost optimization are undertaken by Renault's R&D center in China.

Image Source: Renault

By deeply integrating China's local engineering development capabilities and supply chain network, Renault has achieved significant efficiency improvements. It is reported that through its ecosystem collaboration in China, the comprehensive R&D costs of the projects involved have been reduced by 72%, mold costs have been saved by 31%, and component costs have been cut by 29%. Benefiting from this, the Twingo E-Tech has ultimately achieved its market pricing target of 20,000 euros, and the product development to mass production cycle has been shortened from 200 days to 100 days.

Similar changes have also occurred among other multinational component companies. For example, traditional automotive parts giants such as Mann+Hummel and Tenneco have increased their R&D investments in China in recent years and are gradually applying the research achievements of their Chinese teams to overseas markets.

Under the backdrop of electrification and intelligence, Mann+Hummel has redefined its original business boundaries by relocating its global new energy research center from Germany to Shanghai and simultaneously shifting the focus of its artificial intelligence research eastward. These technology solutions, which first took root in the Chinese market, were subsequently exported to Europe and North America to serve local automotive clients.

The path of Tenek is also representative. In the Chinese market, it faces a customer environment characterized by shorter development cycles, higher cost requirements, and faster technological iterations. This has driven the formation of a more efficient research and development organization and product development process in China. As these capabilities gradually mature, Tenek has begun to feed back the of its Chinese R&D team to its businesses in North America and Europe.

Renault ACDC Team, image source: Renault China

This indicates that an increasing number of multinational automotive companies are beginning to see China as a "testing ground for global operations." New technologies, new architectures, and new supply models are often first validated and matured in the Chinese market before being promoted to other regions. This process is essentially a continuous output of research and development achievements and supply systems.

This further signifies that the innovation path of the global automotive industry is undergoing adjustments. In the past, research and development were mostly concentrated in the region where the headquarters were located, then spread to the global market. Now, China is gradually becoming one of the important sources of research and engineering capabilities. The experiences accumulated by multinational car companies in China are no longer just "local success stories," but are systematically integrated into the global business architecture.

China is becoming increasingly important globally.

From the localization of the core battery supply to the deep collaboration in intelligent network technology, and then to the reverse delivery of an efficient supply chain system, a trend is reflected: China's importance in key decisions, technological paths, and innovation resource allocation in the global automotive industry is continuously rising.

For a considerable period of time, China has been viewed more as "the largest single market" or "an important production base." Multinational car companies have established their presence in China primarily to serve local sales, while research and development and strategic decision-making remain highly centralized at their headquarters.

However, as electrification and intelligence become the main themes of the automotive industry, the advantages of the Chinese market in terms of technological iteration speed, richness of application scenarios, and the integrity of the industrial chain are continuously expanding, breaking the traditional division of labor.

More and more multinational car companies are choosing to establish their largest new energy and intelligent research and innovation centers outside of their headquarters in China.

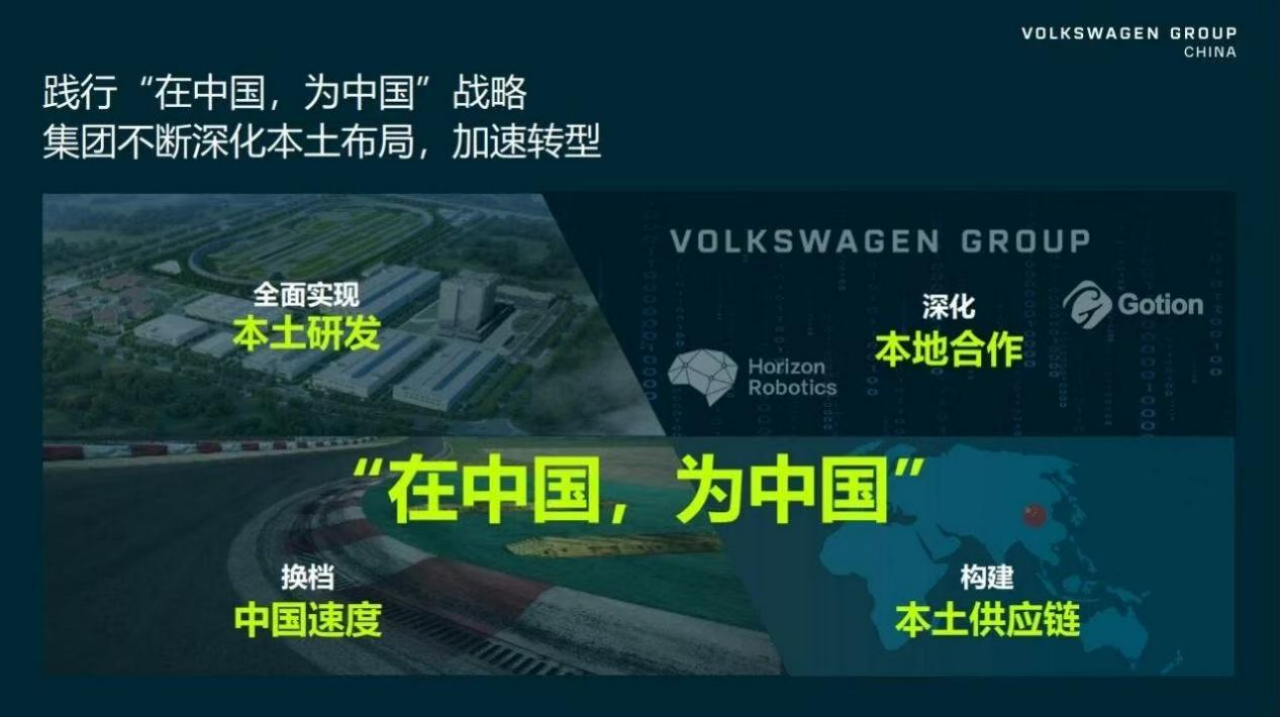

Image source: Volkswagen Group China

For example, the Volkswagen Group has established the largest R&D center outside Germany in Hefei, Anhui, focusing on electrification and digitalization, which has shortened its R&D cycle by 30% and reduced material costs by 40%. Tenneco has integrated multiple business units and innovation centers in the Asia-Pacific region to China in order to more directly tap into the innovative pace of the local market. Over 300 foreign-funded R&D centers have been recognized in Suzhou, Jiangsu.

This is because China is one of the most dynamic and rapidly iterating automotive markets globally, with a complete supply chain ecosystem, providing an irreplaceable environment for the rapid development, testing, and mass production of cutting-edge technologies. Multinational companies establish major R&D centers here, aiming not only for "in China, for China," but also "in China, for the world," delivering technology solutions and development models originating from the Chinese market to their global business systems.

This has also invisibly enhanced the voice of Chinese enterprises in the global automotive industry. When Chinese companies no longer just produce according to established standards, but instead participate in product definition, technology roadmap selection, and even early-stage architectural design, their influence naturally extends to a broader scope.

Especially in new fields such as new energy vehicles and intelligence, traditional rules have not yet been fully solidified. Chinese companies, through large-scale practice and rapid iteration, have accumulated a vast amount of real data and engineering experience, which provides them with a practical foundation for participating in discussions on industry rules and technical standards.

For example, Jiangbolong has accumulated extensive experience in automotive-grade product design and manufacturing by serving numerous OEMs, which provides it with a practical foundation for participating in related standard discussions. Gotion High-Tech provides production line design and process guidance for Volkswagen PowerCo battery factories. SAIC Motor Corporation has achieved mass production of core electric drive technology in Indonesia, promoting the integration of local technical standards.

Image source: Yikatong

The enhancement of this discourse power is not aimed at "replacing" others, but is gradually formed through collaboration. Chinese enterprises integrate their capabilities into the global system by deeply collaborating with multinational car companies and global suppliers; meanwhile, multinational enterprises gain new growth momentum and sources of innovation through the Chinese market.

China's role in the global automotive industry is indeed undergoing profound and sustained changes, from supply chain integration to system collaboration, and to the global flow of R&D capabilities and industrial systems. This transformation stems from the accumulation of a comprehensive industrial system through long-term practice and benefits from the structural window period brought by electrification and intelligence.

However, it is important to note that as Chinese companies increasingly establish their presence in the European automotive industry, related cooperation will face a more complex external environment.

For example, the European market's requirements for industrial security, data compliance, and localization are continuously increasing, and supply chain scrutiny and technical entry barriers may be further tightened. In addition, as Chinese companies gradually enter more core technology and system levels, the competitive relationship will inevitably deepen, and cooperation and competition will coexist in the long term.

In this context, the Chinese automotive industry must remain cautious to truly consolidate the progress it has made.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories