Far exceeding industry average growth: Top 10 Fastest-Growing Medical Device Blockbusters!

In mid-2025, Ernst & Young predicted a global medical device market growth rate of approximately 6% for the year, indicating steady overall market growth. The medical device industry is shifting its growth drivers, with MNCs actively divesting or selling off businesses with slowing growth to focus on high-growth segments. As some areas lose their growth momentum, which new tracks are emerging and becoming new drivers of industry growth?

VCBeat (WeChat ID: vcbeat) has analyzed the performance of major global medical device players and identified ten high-growth single-product categories with growth rates significantly exceeding the industry average. The market size of these categories has increased by over 15% year-over-year. Industry leaders focusing on these categories have achieved rapid growth with innovative products, significantly outperforming their peers.

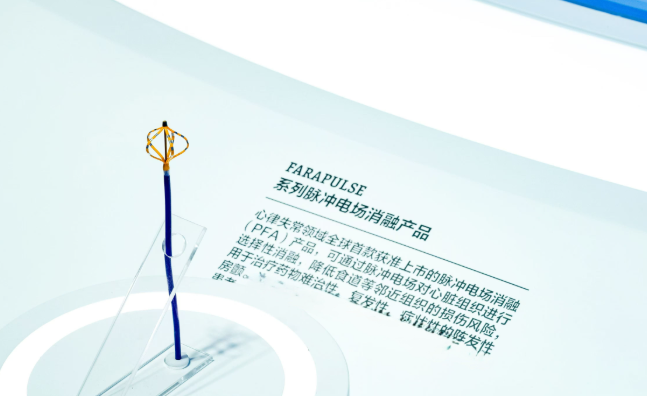

Pulsed field ablation in cardiac electrophysiology is experiencing explosive growth. As an innovative product, pulsed field ablation (PFA) achieved a penetration rate of over 20% in the US electrophysiology market and a market size exceeding $2 billion in less than two years after its approval. Investors believe it has the potential to become the fastest-growing sector in terms of revenue and market size, both domestically and internationally, in history.

Image source: Boston Scientific

PFA's rapid penetration rate is primarily due to its significant clinical value. Pulsed field ablation (PFA) differs from radiofrequency ablation and cryoablation in its high tissue selectivity, enabling effective ablation of diseased myocardial cells while minimizing damage to adjacent vital structures such as the esophagus, phrenic nerve, and coronary arteries. Initial ablation efficacy is clear, with studies showing an immediate pulmonary vein isolation success rate of 98% - 100%. Several studies with 1-year follow-up results suggest a single-procedure success rate of 70% - 80% for paroxysmal atrial fibrillation, non-inferior to traditional thermal ablation, and demonstrating better long-term outcomes in some studies. It can also shorten procedure time and improve surgical efficiency.

The concerted efforts and strong promotion by major players in commercialization are fueling the rapid penetration of PFA. Boston Scientific and Medtronic are currently the dominant players in the global PFA market, with both cardiovascular giants investing heavily in the commercialization of PFA. Boston Scientific's Farapulse PFA system has surpassed 500,000 procedures worldwide. Medtronic's PFA ablation revenue is projected to be approximately $1 billion in fiscal year 2025, with an expected increase of another $1 billion in 2026. Furthermore, the subsequent deployment of PFA by Johnson & Johnson and Abbott, two "kings" of RF ablation in cardiac electrophysiology, provides continuous endorsement for this track.

PFA is far from hitting its market ceiling. At the JPM conference in early 2026, Medtronic positioned PFA as a market exceeding $13 billion with an annual growth rate of over 25%, projecting PFA penetration to increase to 80% by 2028. Building a complete ecosystem, enriching mapping systems and catheter types, and linking with other cardiovascular interventional businesses have become the strategic consensus among major players.

Looking at the domestic PFA market, it is still in its introductory phase. Over 5 domestic products have been approved, driving rapid growth in clinical applications. Domestic products are also being updated and iterated quickly, taking the lead in deploying multiple innovative technologies in the PFA field. It is expected that after industry integration, gradual improvement of product support, continuous optimization of stability, and enhancement of image precision, domestic cardiac electrophysiology companies are expected to rise with PFA technology.

The rapid breakthrough of disposable endoscopes in the global medical device landscape is the result of the resonance between clinical needs and industrial transformation.

Single-use endoscope Image source: Ambu

From a clinical value perspective, single-use endoscopes solve the problem of cross-contamination associated with reusable endoscopes and significantly reduce hospital procurement and disinfection costs. In recent years, the penetration rate of single-use endoscopes has rapidly increased globally, achieving high penetration in urology and quickly expanding to multiple other departments.

From the perspective of industrial transformation, disposable endoscopes are products born from technological revolution and industrial innovation. The rapid development of CMOS image sensor chip technology, the independent control of domestic chips, and large-scale, automated production have greatly reduced the cost of disposable endoscopes, laying the foundation for their application in multiple departments.

The performance of the global leader has given clear signals of continued growth. Global single-use endoscope pioneer Ambu saw revenue growth exceeding 25% in urology, ENT, and gastroenterology departments for single-use endoscopes in the first three quarters of 2025. Even with a slowdown in the respiratory area, overall momentum remains strong. CEO Britt Meelby Jensen expects the market to maintain a compound growth rate of over 20% in the future. The company is not only following demand but also actively driving the shift in departmental usage habits. Ambu will focus primarily on urology and respiratory, followed by ENT, gradually guiding the transition from reusable to single-use endoscopes within these departments.

The single-use endoscope market still has broad prospects. While the global endoscope market grows at an annual rate of about 5%, single-use endoscopes have maintained growth of over 20% for two consecutive years. With the continued rise in aging populations, chronic diseases, and the demand for minimally invasive surgery, hospitals will increasingly rely on safe, efficient, and cost-effective solutions. Subsequently, as disposable endoscopes further improve in image clarity, rivaling traditional endoscopes, they are even expected to achieve substitution in the field of gastroenteroscopy.

Leveraging supply chain advantages and rapid response capabilities, domestic Chinese companies have become a core global supply force, collaborating with giants like Olympus, Cook, and Hologic to expand overseas and propel "Made in China" onto the global stage. Following the inclusion of single-use flexible ureteroscopes in national centralized procurement in 2026, significant price reductions will further drive a surge in domestic penetration rates, creating a dual acceleration of demand explosion and cost reduction.

Over the 20 years since the introduction of laparoscopic surgical robots, their penetration rate in global minimally invasive surgery is still less than 15%, but the market size has exceeded tens of billions of US dollars, with an average annual market growth rate of over 20%. Their life cycle has surpassed that of typical innovative medical devices.

Da Vinci Surgical Robot Arm Image Source: Intuitive Surgical

The enduring success of surgical robots in endoscopic surgery hinges on their widely recognized clinical value. Laparoscopic surgical robots offer clinical value across multiple departments, primarily used in critical and complex tumor surgeries, significantly reducing the difficulty of laparoscopic procedures. A laparoscopic surgical robot typically consists of a surgeon console, a patient-side cart, and an imaging system. Surgeons remotely control surgical instruments connected to robotic arms via the patient-side cart to perform surgical steps such as compression, cutting, coagulation, dissection, suturing, and tissue manipulation. Compared to manual operation, it is more precise and can more easily complete surgery in confined spaces.

Intuitive Surgical's new products are also injecting a continuous stream of growth momentum into the market. The global surgical robotics market for minimally invasive surgery is dominated by Intuitive Surgical's da Vinci surgical robot. The da Vinci surgical robot has been around for over 20 years and has undergone five generations of innovation, each achieving leaps in image display, advanced surgical instrument compatibility, and operability. The latest generation, da Vinci 5 (FDA approved in 2024), boasts powerful computing capabilities and force feedback functionality. This new product has accumulated 1232 installations over two years, with 870 installations in 2025 and 362 installations in 2024. Continuous innovation has driven sustained market growth.

Sustained innovation has also led to significant financial returns. In 2025, Intuitive Surgical, the parent company of the da Vinci Surgical System, saw revenue exceeding $10 billion, a 21% year-over-year increase. The growth rate of da Vinci surgical robot procedures in 2025 is projected to be between 13% and 15% year-over-year. Throughout 2025, a total of 1,721 da Vinci surgical systems were installed, bringing the total installed base higher than the 1,526 units in 2024.

The surgical robotics market will see more intense competition in 2026. At the 2026 JPM Conference, both Johnson & Johnson and Medtronic highlighted laparoscopic surgical robots as key initiatives, with their differentiation from Intuitive Surgical's da Vinci robot being the integration of surgical robots with advanced minimally invasive surgical instruments.

The domestic surgical robot market is also ushering in a period of growth. According to data from Zhongcheng Shuke, domestic endoscopic surgical robots achieved sales of 119 units in China from January to November 2025. Simultaneously,====(Guo Chan - meaning domestically produced) endoscopic surgical robots experienced better-than-expected growth in overseas markets in 2025. After establishing channels and building brands in emerging markets, these==== endoscopic surgical robots are expected to continue growing. In 2026, it is anticipated that domestic large-scale medical equipment configuration certificates will be further liberalized, driving the expansion of the domestic endoscopic surgical robot market.

Laparoscopic surgical robots, with their massive and intricate engineering systems, establish a "heavyweight innovation" in medical technology, while CGMs, with their tiny and nimble size, prove that coin-sized products can also carve out a rapidly growing, multi-billion dollar market.

CGM Image Source: Yuwell

CGM addresses the pain points of the chronic disease management market by using biosensors and algorithm technology to innovatively solve the problem of chronic disease management for diabetes patients. Continuous glucose monitoring (CGM) is a technology that continuously monitors glucose levels in subcutaneous interstitial fluid using a glucose sensor, indirectly reflecting blood glucose levels and providing continuous, comprehensive, 24-hour glycemic information. It represents a shift from finger-prick blood glucose testing to seamless, around-the-clock glucose monitoring.

From an industry perspective, rapid coverage of healthcare in the US has driven the rapid growth of CGM adoption. The global CGM market is dominated by Abbott and Dexcom. In the US, Medicare included CGM coverage in 2017 and has been continuously expanding its coverage, significantly reducing the technological burden for patients adopting innovative products. Abbott's CGM product sales are projected to exceed $8 billion in 2025, with a year-over-year increase of approximately 23%. Dexcom expects its revenue to reach $4.63-4.65 billion in 2025, with a year-over-year increase of approximately 15%.

There is still significant market growth potential for CGM. Abbott believes the current penetration rate of CGM is approximately 20% in the US and 5% globally, and expects the CGM market to grow further by 2026.

Although not yet covered by national medical insurance in China, CGM has successfully opened up the self-pay market, leveraging the cost advantages of domestic companies in the supply chain and manufacturing. Industry leaders are performing particularly strongly: MicroTech Medical's CGM revenue reached RMB 143 million in the first half of 2025, a year-on-year increase of 91.5%; Yuwell Medical also publicly stated that its CGM business maintained significant growth and its market share continued to rise. It can be seen that, driven by the dual forces of cost reduction and demand expansion, the domestic CGM market is entering a period of accelerated penetration driven by out-of-pocket spending.

Mechanical thrombectomy ushered in a multi-billion dollar acquisition at the very beginning of 2026, with the giant's acquisition betting bringing long-term value endorsement to this field.

InThrill Thrombectomy System Image source: Stryker

From a clinical perspective, mechanical thrombectomy is rapidly emerging in the vast and complex field of vascular intervention due to its advantages of broad indication coverage, rapid vessel recanalization, and shortened treatment time. It delivers the device directly to the thrombus site percutaneously to mechanically remove the thrombus, making it particularly effective for patients with acute or subacute, central, or mixed deep vein thrombosis. Compared to catheter-directed thrombolysis, it is more time-saving, requires less medication, and results in shorter hospital stays, offering more pronounced advantages in patients with low bleeding risk and longer life expectancy.

Industrial actions are further pushing this sector into the spotlight. Inari Medical and Penumbra led the global market, both companies acquired by giants for substantial sums.

Inari Medical was acquired by Stryker in 2025 for $4.9 billion. Following the acquisition, Inari contributed $590 million in revenue within 10 months, with a remarkable 52.3% year-over-year growth in Q2 2025, making it Stryker's fastest-growing business segment.

Penumbra, with its thrombectomy system as its core product, was acquired by Boston Scientific for $14.5 billion in 2026. The company anticipates revenue growth of 21.4%–22.0% in Q4 2025, with full-year revenue of approximately $1.4 billion, representing a year-over-year increase of 17.3%–17.5%.

The domestic market is also showing strong momentum. A large patient base with vascular diseases coupled with mature technology has enabled mechanical thrombectomy to maintain a high growth rate of over 20% in China, with multiple domestic products having been approved. As more vascular interventional companies deploy synergistic product lines, future penetration rates are expected to further increase.

Structural heart disease is one of the fastest-growing areas in the cardiovascular field in recent years, and transcatheter mitral and tricuspid therapies (TMTT) are among the fastest-growing segments within structural heart disease.

TMTT's emergence as one of the fastest-growing tracks in the medical device industry is no accident, but a convergence of clinical value, industrial strength, and future potential.

From a clinical value perspective, transcatheter mitral and tricuspid valve therapies (TMTT) are reshaping the landscape of cardiovascular treatment. Traditional open-heart surgery carries high risks for elderly patients, while TMTT, with its minimally invasive approach, truly addresses the most challenging gap in valve disease treatment in the aging era, driving a structural shift in global treatment paradigms.

From the perspective of industrial promotion, the performance of multinational giants provides the most direct answer. Abbott's mitral and tricuspid valve business continues to climb, and Edwards Lifesciences' TMTT revenue reached $1.452 billion in 2025Q3, a surge of 59.3% year-on-year, with PASCAL and EVOQUE becoming the dual engines driving growth. Continuous corporate investment and rapid product iteration have led to a growth trend in this track, characterized by technological breakthroughs and accelerated commercialization.

The domestic market is also accelerating its catch-up: TMTT is expanding from "three licenses" in 2024 to "six licenses" in 2025, and the leap in supply is igniting the potential of demand.

Looking at the future prospects, the story of this market is far from its climax. Globally, companies widely believe that the penetration rate of TMTT is still in its early stages, and the real growth cycle has just begun. In China, the combination of a huge patient base and rapidly expanding innovative supply will give this track long-term explosive power.

Bronchoscopy surgical robots are poised to become one of the fastest-growing segments in the medical device field by 2025, with the product experiencing large-scale commercialization and release in 2025.

Schematic diagram of Ion application via bronchoscope

Bronchoscopic surgical robots address the core pain points of early lung cancer screening and diagnosis. Bronchoscopic surgical robots, by incorporating robotic navigation and remote control technologies, enable preoperative 3D reconstruction of the bronchial tree and trajectory planning. During the procedure, they combine virtual image and real-time image navigation. Surgeons can remotely control the movement of the flexible bronchoscope's tip in real time via a controller, reaching over 90% of lung segments (including sixth-order and higher segments of the bronchus). Real-time and precise biopsies or ablation procedures can be performed, improving the diagnostic accuracy and early treatment outcomes of lung lesions.

2025 will be the year that transbronchial robots truly enter a phase of scaled-up mass production and adoption. Globally, three main bronchoscopy surgical robots have received FDA approval: Intuitive Surgical's Ion platform with a single robotic arm, Johnson & Johnson's Monarch platform with dual robotic arms, and Noah Medical's Galaxy System.

Intuitive Surgical's Ion platform has reached an installed base of 905 units, with a cumulative total of 38,000 procedures performed. Procedure volume growth is expected to exceed 50% in 2025, and the high device utilization rate indicates that bronchoscopy robots are in a phase of scaled deployment. The market is no longer in an installation validation period but has entered a phase of clinical demand-driven, large-scale growth.

Domestically, positive news has also emerged in this market. The National Healthcare Security Administration has officially released the "Establishment Guidelines for Medical Service Price Items for Surgical and Therapeutic Auxiliary Operations (Trial)," providing a national standard for charging in this field. In the future, products that can simultaneously complete diagnostic and therapeutic procedures are expected to win greater market space.

In 2025, the aesthetic medicine market is facing headwinds, putting pressure on growth globally. However, some products have achieved high-speed growth, overcoming the adverse conditions. "Sculptra" (or similar "collagen-stimulating filler") has experienced rapid growth in the Chinese market.

Poly-L-lactic acid (PLLA) facial fillers are regarded in the medical device field in 2025 as High-growth sector , with the core reason being that its "stimulating collagen regeneration" mechanism aligns with the aesthetic preferences of Chinese consumers who desire Natural, long-lasting, low-risk Regarding anti-aging preferences, as aesthetic medicine consumption upgrades from "filling" to "regenerative," PLLA is rapidly becoming a key project for institutions to develop due to its longer-lasting tissue improvement capabilities, and is driving the trend. The expansion trend of regenerative medicine-based aesthetic products. 。

Domestic growth is primarily driven by three factors: Firstly, sustained increase in consumer acceptance of "light medical aesthetics for anti-aging," characterized by high average transaction value and repurchase rates; Secondly, stricter regulatory oversight of compliant medical aesthetic devices, enhancing the competitiveness of PLLA products with clinical evidence and compliance qualifications; Thirdly, continuous innovation by domestic enterprises in production processes, particle stability, and injection experience, lowering the barrier to entry and driving the adoption of PLLA products. Acceleration of domestic substitution 。

Currently, the market landscape is characterized by "leading imported brands and rapidly catching-up domestic brands." International manufacturers leverage mature clinical data and brand recognition to dominate the high-end market, while domestic companies are rapidly expanding their market share through cost-effectiveness and channel penetration. In the future, the PLLA market will move towards... Product differentiation 、Indication Expansion Combination therapy Directional development is expected to maintain high growth rates from 2025 to 2027, becoming one of the most promising subcategories in the regenerative aesthetics field.

A blockbuster product has emerged in the home medical device market: non-invasive ventilators. The rapid growth of non-invasive ventilators is related to increased consumer health awareness, the reshaping of the market landscape, and the globalization strategies of domestic enterprises.

ResMed non-invasive ventilator Image source: ResMed official website

In 2025, the non-invasive ventilator market continued its strong growth momentum, with a notable rebound in the US market. Non-invasive ventilators are mechanical ventilation devices that deliver continuous positive airway pressure to users through the mouth and nose in a non-invasive manner to control or assist breathing, primarily used for the treatment of sleep apnea-hypopnea syndrome.

Philips' ventilator recall reshapes the global market landscape, with domestic Chinese companies seizing the initiative through globalized strategies. ResMed's revenue for the first three quarters exceeded 800 million yuan, a year-on-year increase of 34.24%, and net profit reached 180 million yuan, a year-on-year increase of 43.87%, of which overseas revenue was 558 million yuan, a year-on-year increase of 52.96%. Yuwell Medical's respiratory therapy products are pioneers in overseas expansion, with ventilators and masks maintaining rapid growth and achieving breakthroughs in key countries and regions.

Driven by increasing consumer health awareness, the non-invasive ventilator market is projected for continued robust growth. At the 2026 JPM Conference, ResMed noted that the treatment penetration rate for Obstructive Sleep Apnea-Hypopnea Syndrome (OSA) remains low, with penetration in the US market under 20% and even lower than 10% in other regions globally. Factors driving market expansion include heightened consumer health consciousness, the widespread use of GLP-1 drugs leading to increased awareness of sleep apnea, continuous sleep quality monitoring via wearable devices, and the growing pressure on healthcare systems prompting payers and providers to prioritize preventative care.

Another billion-dollar blockbuster has emerged in the field of vascular intervention: Shockwave intravascular lithotripsy (IVL) balloons. This makes it Johnson & Johnson's 13th medical device product exceeding one billion dollars in sales.

Shockwave E8 Hero Image Source: Johnson & Johnson Official Website

IVL is poised to break the $1 billion mark and achieve high growth, with its core clinical value lying in solving the calcification challenge. IVL uses acoustic pressure waves to precisely target calcified lesions in the intima and media of the coronary artery. Without damaging the intimal structure of the vessel, it effectively loosens or fractures calcified tissue, restoring vessel compliance, thereby creating more ideal operating conditions for subsequent stent implantation.

According to Johnson & Johnson's disclosure, IVL has a penetration rate of approximately 10% in coronary interventional therapy in the United States. In addition to Johnson & Johnson, companies such as Boston Scientific and Abbott are also actively investing in this field. Considering that approximately 30% of patients with coronary atherosclerosis have calcified lesions, IVL still has significant room for penetration improvement in clinical settings. With the launch of more products, the market is expected to expand further.

The above-mentioned major areas reveal that innovative products bring new prosperity opportunities to medical devices, driving high market growth. Whether to prospectively lay out high-growth areas and how to continuously innovate after the launch of innovative products become key competitive points. In the domestic market, innovation competition is generally more intense. Companies need to go through brutal battles to win market share before ushering in steady growth.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories