India To Continue Imposing Anti-Dumping Duties On Imports Of "Soft Foam Polyether Polyol" From Saudi Arabia And UAE

The Indian Ministry of Finance has extended the period for imposing anti-dumping duties on the import of flexible slabstock polyether polyol from Saudi Arabia and the UAE until June 17, 2026.

On January 2, 2026, the Indian Ministry of Finance announced the extension through its Customs (Anti-Dumping) Notification No. 01/2026, amending the anti-dumping notification previously issued in April 2021.

Soft block foam made from polyether polyols (molecular weight range 3000-4000) is a key raw material for the production of polyurethane foam, widely used in furniture, mattresses, car seats, and insulation materials. The product in question is classified under Indian Customs tariff code 3907 29.

In April 2021, Indian authorities first imposed anti-dumping duties on the product after discovering that it was being dumped into the Indian market at prices below normal value from Saudi Arabia and the UAE, causing material harm to the domestic industry.

As the designated authority, the Directorate General of Trade Remedies (DGTR) of India initiated a sunset review on March 18, 2025, under Section 9A(5) of the Customs Tariff Act of 1975 and Rule 23 of the Anti-Dumping Rules of 1995. This review aims to assess whether the termination of anti-dumping duties is likely to lead to the continuation or recurrence of dumping and to cause injury to Indian manufacturers.

After the review is initiated, the Directorate General of Trade Remedies (DGTR) in India recommends continuing to impose anti-dumping duties until the sunset review investigation is completed.

The Central Government of India has now adopted the recommendation of the designated authority, the Directorate General of Trade Remedies (DGTR), to amend the original notification by adding a clause stating that the anti-dumping duty will continue to be in effect until June 17, 2026 (inclusive), unless revoked, replaced, or modified earlier.

It is reported that since April 2021, India has imposed anti-dumping duty rates on related products as follows:

An anti-dumping duty of USD 150.06 per ton is imposed on the polyether polyol used for flexible slabstock foam, produced by Sadara in Saudi Arabia, with a molecular weight range of 3000-4000.

For other producers and exporters in Saudi Arabia, the anti-dumping duty is $235.02 per ton.

For other producers and exporters in the UAE, the anti-dumping duty is $101.81 per ton.

On March 18, 2025, according to the application from the Indian company M/s Manali Petrochemicals Limited, the Indian Ministry of Commerce and Industry issued a notice stating its decision to initiate an anti-dumping investigation on polyether polyols used in flexible slabstock foams originating from or imported from China and Thailand.

The dumping investigation period is from September 1, 2023, to September 30, 2024, and the injury investigation periods are from April 1, 2021, to March 31, 2022; April 1, 2022, to March 31, 2023; April 1, 2023, to March 31, 2024; and the dumping investigation period.

The product involved is polyether polyol for flexible slabstock foam (with a molecular weight range of 3000–4000). This product is classified under Chapter 39 "Plastics and Articles thereof" of India's Customs Tariff Act, with the tariff code 3907, and under subheadings 3907 29 10 and 3907 29 90. Additionally, during part of the injury period from April 1, 2021, to January 31, 2022, the product was also imported under subheading 3907 20. The customs classification is for reference only and does not have a decisive binding effect on the scope of the product involved.

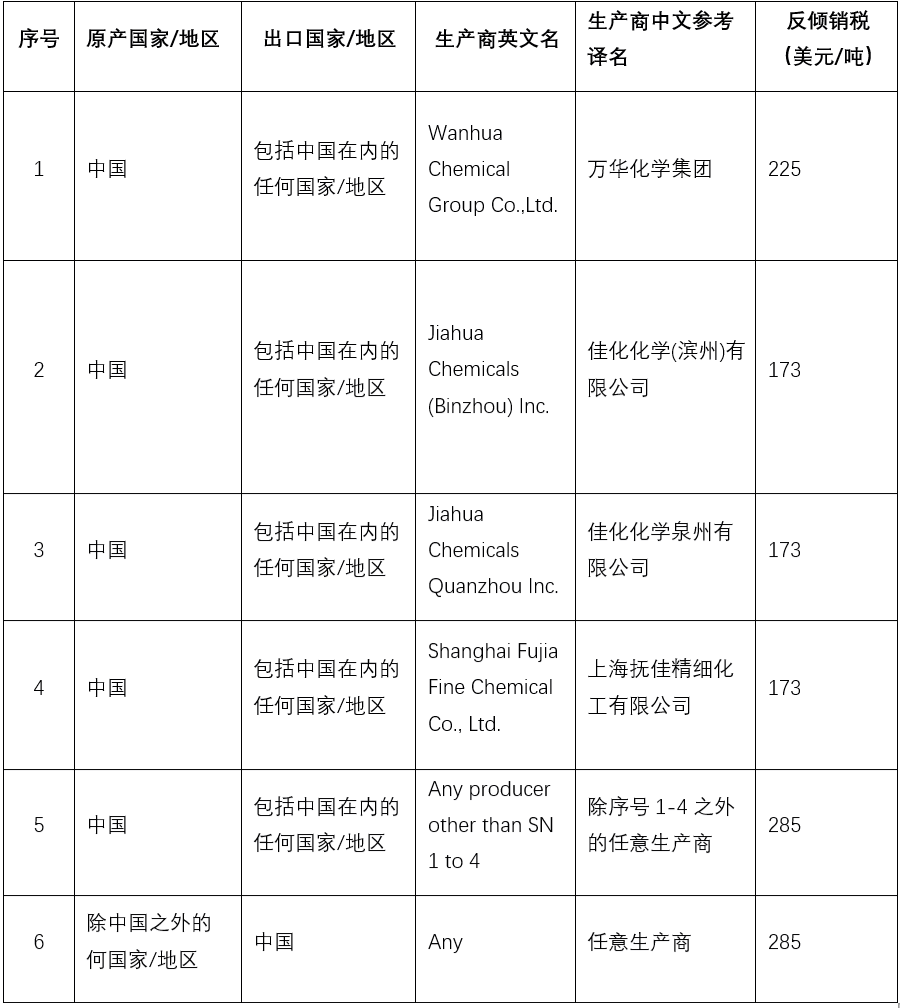

On September 26, 2025, the Indian Ministry of Commerce and Industry issued a public notice, announcing a positive final determination in the anti-dumping investigation concerning Copolymer Polyol with a hydroxyl value greater than or equal to 23.5, originating from or imported from China. It is recommended that an anti-dumping duty be imposed on the products involved for a period of five years, with the duty amount ranging from 173 to 285 USD per ton. Details of the duty can be found in the attached table.

The case involves products under Indian customs code 3907. Polyester polyol with a hydroxyl value ≥23.5 is not within the scope of the products involved in the case.

On September 30, 2024, the Ministry of Commerce and Industry of India issued an announcement stating that, upon the application submitted by the Indian domestic company Expanded Polymer Systems Pvt. Ltd., an anti-dumping investigation has been initiated on copolymer polyols with a hydroxyl value greater than or equal to 23.5, originating from or imported from China. The dumping investigation period is from April 1, 2023, to March 31, 2024 (12 months), and the injury investigation periods are from April 1, 2020, to March 31, 2021, from April 1, 2021, to March 31, 2022, from April 1, 2022, to March 31, 2023, and from April 1, 2023, to March 31, 2024.

Appendix: Final Anti-Dumping Duty Recommendation Table for Indian Polyol Copolymers from China

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories