Industry faces winter, home appliance supply chain under pressure seeking path

In the second half of 2025, the home appliance industry will officially enter a period of deep adjustment against the backdrop of the diminishing effects of the "national subsidy" policy, weak growth in domestic and foreign demand, and the pressure of high comparatives. According to research by AVC (AVC), it is estimated that the retail sales of home appliances from September to December 2025 will decline by at least 16.4% year-on-year, posing severe challenges to the industry as a whole. Whether the traditional promotional peak season in the fourth quarter can reverse the downturn has become a focus of attention in the industry.

1. Retail Decline and Structural Differentiation: Market Pains Following Policy Retraction

The overall trend in the home appliance market is characterized by a "high start and low finish." In the first and second quarters of 2025, as well as in July and August, there was still slight growth compared to the same period in 2023, but the growth rate narrowed each quarter. By September, market fatigue became evident. According to monitoring data from Aowei Cloud Network, during weeks 36-37, online retail sales declined by 16.0% year-on-year, while offline sales saw an even more significant drop of 23.5%. The "seven major categories" such as televisions, air conditioners, refrigerators, and washing machines all showed significant slowdowns in growth.

The "reduction of national subsidies" is one of the core factors leading to the weakening of market momentum. In the same period of 2024, the home appliance industry achieved high growth under the strong stimulation of national subsidy policies, with a year-on-year increase in retail sales of 23.8%, forming a high base. However, in 2025, the national subsidy policy shifted to "phased distribution and controlled limitation," with the stimulating effect decreasing month by month. Taking air conditioners as an example, the year-on-year increase in the home appliance market in July-August 2025 has narrowed to 7%, making it difficult to replicate the booming situation of the same period last year.

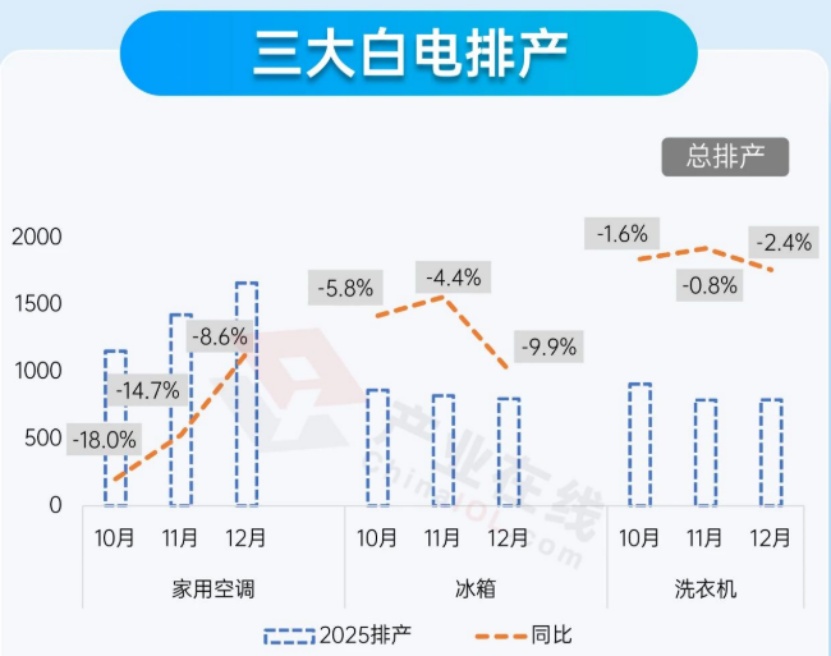

On the production side, companies' production scheduling plans also reflect a cautious outlook for the future market. According to data from Industry Online, the total production schedule for air conditioners, refrigerators, and washing machines in October 2025 decreased by 9.9% year-on-year, with the production schedule for domestic air conditioners falling by 18% year-on-year, and refrigerators and washing machines decreasing by 5.8% and 1.6%, respectively. Companies are waiting for the allocation of national subsidy funds and the clarification of next year's policies, leading to more conservative production decisions.

In the second half of 2025, the home appliance industry officially enters a deep adjustment period due to the diminishing effects of the "national subsidy" policy, sluggish growth in domestic and external demand, and the pressure of a high base. According to research by All View Cloud (AVC), it is estimated that the retail sales of the home appliance market from September to December 2025 will decline by at least 16.4% year-on-year, posing severe challenges for the entire industry. Whether the traditional promotional peak season in the fourth quarter can reverse this downturn has become the focus of attention in the industry.

1. Retail Decline and Structural Differentiation: Market Pain in the Wake of Policy Retreat

The overall performance of the home appliance marketThe trend of "opening high and moving low" continued. In the first and second quarters of 2025, as well as in July and August, there was a slight year-on-year increase compared to the same period in 2023, but the growth rate gradually narrowed each quarter. Entering September, market fatigue became apparent. According to data monitored by Aowei Cloud Network, during weeks 36-37, online retail sales fell by 16.0% year-on-year, while offline sales saw a significant decline of 23.5%. The categories of major appliances such as color TVs, air conditioners, refrigerators, and washing machines all experienced a noticeable slowdown in growth.

"Reduction in national subsidies" is one of the core factors leading to weakened market momentum. In the same period of 2024, the home appliance industry achieved high growth under the strong stimulus of national subsidy policies, with retail sales increasing by 23.8% year-on-year, forming a high base. However, in 2025, the national subsidy policy shifted to "phased issuance and flow control," with the pulling effect decreasing month by month. Taking air conditioners as an example, the year-on-year growth rate of the home appliance market narrowed to 7% in July-August 2025, making it difficult to replicate the booming situation of the same period last year.

On the production side, companies' production scheduling plans also reflect cautious expectations for the future market. According to data from Industry Online,In October 2025, the total production of air conditioners, refrigerators, and washing machines declined by 9.9% year-on-year, with domestic production of air conditioners decreasing by 18%, while refrigerators and washing machines fell by 5.8% and 1.6%, respectively. Companies are waiting for the disbursement of national subsidies and clarity on next year's policies, leading to a more conservative production decision-making approach.

II. Category Differentiation and Intensified Competition: Coexistence of Price Wars and Quality Wars

Despite the overall market pressure, different categories exhibit significant structural differences. The air conditioning market is facing...Under the dual pressure of a "high base + demand overdraft," air conditioner sales across all channels are expected to decline by 8.0% year-over-year during the National Day and Double Eleven periods, with sales revenue decreasing by 14.4%. The risk of a price war is intensifying, and some brands may proactively cut prices to maintain market share, leading the industry into a vicious cycle of "trading price for volume." However, Xiaomi has announced a "10-year free repair service" for air conditioners, which is shifting industry competition from price to service and quality upgrades, becoming the direction for breaking the deadlock.

The refrigerator category has become the most severely impacted field, with a negative growth rate possibly exceeding...The market competition is expected to focus on the mid-to-high-end price range of 6000-8000 yuan, where various brands will engage in fierce competition. The decline in the laundry care market is relatively moderate, but there is still downward pressure on prices. High-end functional products like heat pump washer-dryers and dryers, as well as green energy-saving products, have become key areas for brands to focus on. There are still structural opportunities in niche markets.

3. Channel Strategy Adjustment and Export Pressure: Online and Offline Divergence, Global Layout as the Key

With the weakening impact of national subsidies, channel performance has shown differentiation. The offline channels, which benefited from the subsidies last year and had a high base, have seen a significant reduction in growth momentum this year.The TOP channel is driving customer traffic, even leading to "price inversion." Supported by the "Double Eleven" promotion, online channels are expected to perform better than offline ones. Platforms like JD and Tmall, by combining national subsidies with platform discounts, are likely to achieve a certain degree of traffic aggregation during promotional periods.

It is worth noting thatIn 2025, the central government's 300 billion yuan "trade-in" funds have all been allocated, and the fourth batch of 69 billion yuan will be in place before "Double Eleven." This provides a certain level of policy support for the market. However, compared to the comprehensive openness of the national subsidies at the beginning of 2024, the intensity of this policy stimulus is relatively mild and is unlikely to completely reverse the downward trend of the market.

The overseas market is also facing challenges. The United States plans to...Starting from November 1, a 100% tariff will be imposed on Chinese goods. Although the policy has not been fully implemented, it has already impacted export orders and manufacturers' business expectations. According to data from Industry Online, air conditioner export production from September to November decreased by 7.89% to 16.69% year-on-year, reflecting companies' cautious attitude in the face of high overseas inventory and trade policy uncertainties.

Facing export pressure, leading companies===="Manufacturing Going Global" and "Brand Localization" are proactive responses. Companies like Midea, Gree, and Hisense are accelerating the establishment of manufacturing bases in Southeast Asia, Europe, and other regions, promoting a "regional supply for regional demand" supply chain model to circumvent tariff barriers. At the same time, they are strengthening overseas brand building through sports marketing and social media advertising to enhance the influence of their own brands.

In the fourth quarter of 2025, the home appliance industry faces severe short-term growth challenges under the multiple pressures of "declining national subsidies, high base numbers, and weak external demand." While the market downturn certainly brings pain, it also accelerates the industry's shift from extensive growth to refined operations. The focus of competition is gradually extending from mere price wars to a comprehensive comparison of quality, service, industrial chain layout, and global operational capabilities.

Author: Expert in Market Research at Specialized VisionZhao Hongyan

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories