Toray Launches Scalable Nanofiltration Membrane Tech; Borealis & Borouge Unveil New Brand Recleo

International News Guide

Raw Material News - Borealis and Borouge Launch Global Brand "Recleo" for Mechanically Recycled Polyolefins

Medical News - Jabil Upgrades Minimally Invasive Medical Device R&D Capabilities, Advanced Catheter Lab Settles at HQ

Automotive News - EU Confirms Delay in Auto Industry Proposals; CBAM Expansion Likely Postponed

Electronics News - Toray Unveils Scalable Nanofiltration Membrane Tech with Over 95% Lithium Recovery Rate from Spent Batteries

Macroeconomic News - Indonesian Official: Tariff Talks with U.S. Progressing as Planned

Price Information - CNY/USD Central Parity Rate at 7.0753, Up 20 Pips

Details of International News

1. Borealis and Borouge Launch Global Brand "Recleo" for Mechanically Recycled Polyolefins

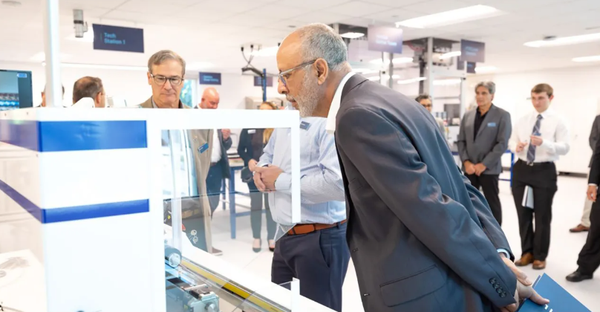

2. Jabil Upgrades Minimally Invasive Medical Device R&D Capabilities, Advanced Catheter Lab Settles at HQ

Jabil recently announced the official opening of a new Advanced Catheter R&D Laboratory at its headquarters in St. Petersburg, Florida, U.S. As a collaborative R&D and manufacturing partner for original equipment manufacturers (OEMs), the company noted that this lab will further expand its capabilities in the minimally invasive medical device technology sector.

Affiliated with Jabil’s Innovation Center, the lab focuses on engineering design, prototype development, and new product introduction for advanced catheters and related devices. Jabil added that its technical experts will collaborate with researchers from the University of Florida and the University of South Florida to develop next-generation medical devices based on real-world clinical operating room scenarios, bridging the gap between academic research and clinical application.

3. Toray Unveils Scalable Nanofiltration Membrane Tech with Over 95% Lithium Recovery Rate from Spent Batteries

Plastics Insight reported that Toray has launched a scalable nanofiltration technology capable of recovering over 95% of lithium from spent batteries, boosting efficient recycling and future clean energy transition. Toray Industries, Inc. announced a major technological breakthrough: the development of a scalable, durable, and highly selective nanofiltration membrane element designed to recover high-purity, high-yield lithium from spent automotive lithium-ion batteries.

This innovation addresses a core pain point in current battery recycling processes—large amounts of high-value lithium are often lost or discarded. By improving recovery efficiency, Toray’s technology helps build a more sustainable lithium resource cycle, which is crucial for global decarbonization and electric vehicle (EV) popularization. With the accelerated shift to electrified mobility, establishing a closed-loop system for battery materials (especially lithium) has become a key industrial and environmental priority. The rapid adoption of lithium iron phosphate (LFP) batteries (which contain no nickel or cobalt) further underscores the urgency of developing large-scale, efficient lithium extraction technologies.

Toray’s latest nanofiltration technology directly meets this demand: it can recover lithium with high purity and yield from various lithium-ion battery chemistries, including nickel-cobalt systems and LFP. Beyond lithium, the system can also recover strategic metals such as nickel and cobalt, which are essential for next-generation battery manufacturing. The technology leverages a positively charged membrane design to enhance selectivity for monovalent lithium ions through electrostatic repulsion, ensuring stability even in acidic battery leachate environments.

4. Ascend Performance Materials Gets Reorganization Plan Approved

According to PR Newswire, Ascend Performance Materials (hereafter "Ascend"), a globally renowned producer of high-performance durable chemicals and engineering materials used in daily life and emerging technologies, announced that the U.S. Bankruptcy Court for the Southern District of Texas has approved its Chapter 11 reorganization plan. This progress marks a key milestone for the company to successfully complete the Chapter 11 restructuring process in the coming weeks, after which its debt will be significantly reduced and its capital structure will become more robust, laying a solid foundation for future development.

Chapter 11 of the U.S. Bankruptcy Code provides court protection to give companies time to restructure while continuing operations to address financial challenges. With the support of its creditor institutions, Ascend will use the Chapter 11 process to maximize value through restructuring. This reorganization represents a proactive measure by the company to address challenges and move toward high-quality development. Upon completion, Ascend’s capital structure will be significantly optimized, with enhanced risk resistance and market competitiveness, becoming a healthy, well-capitalized enterprise.

5. $2.03B Deal: Medical Device Giant Sells Three Business Segments

On December 9, 2025, U.S. medical device company Teleflex announced a notable asset sale: it will transfer its acute care, interventional urology, and OEM businesses to different acquirers for a total consideration of $2.03 billion (approximately RMB 14.3 billion). After deducting taxes and fees, the expected net cash proceeds will be about $1.8 billion, and the transaction is expected to close in the second half of 2026.

Beyond financial adjustments, this deal reflects a strategic shift. The company simultaneously announced a stock repurchase program of up to $1 billion—a clear capital strategy of "asset sales + share repurchases" amid the current capital environment. The short-term market response has reflected changing sentiment: the stock price rose by more than 10% on the day of the announcement. However, more worthy of discussion than stock price fluctuations is the logic behind this multinational company’s decision to "downsize" at this time, signaling a focus on core high-growth businesses.

6. EU Confirms Delay in Auto Industry Proposals; CBAM Expansion Likely Postponed

According to Reuters, on December 8, the European Commission confirmed it has delayed the release of a high-profile auto industry proposal by one week. The proposal may weaken provisions related to the 2035 ban on new fuel vehicles.

Previously, a draft EC schedule obtained by Reuters showed that the EU would delay not only the release of the auto industry package but also the announcement of the Carbon Border Adjustment Mechanism (CBAM) expansion plan, which intends to include washing machines and other industrial manufactured goods in the scope of carbon tariff collection. Both proposals were originally scheduled for release on December 10 and are now tentatively postponed to December 16. An EC spokesperson confirmed the new release date for the auto industry proposal but declined to disclose the adjusted timeline for other policies. Currently, EU departments are negotiating to finalize the proposal release schedule by the end of this year, with consultations still ongoing.

Notably, the CBAM is set to enter its mandatory phase in 2026, after a transition period (2023-2025) where only reporting is required without actual payment. The planned expansion will cover downstream sectors such as chemicals and plastics, making the delay particularly relevant for global manufacturers preparing for compliance.

7. India Revokes Anti-Dumping Duties on Chinese Titanium Dioxide, Restoring Competitiveness for Chinese Enterprises

India’s Central Board of Indirect Taxes and Customs (CBIC) issued Customs Notification No. 33/2025, instructing all local authorities to immediately cease the collection of anti-dumping duties on titanium dioxide (TiO₂) originating from or exported from China. This decision stems from a ruling by the Calcutta High Court on September 22, 2025, which found serious flaws in the Indian government’s previous anti-dumping investigation process and thus revoked the tax notification issued on May 10, 2025.

This means Indian customs has lifted the heavy burden of anti-dumping duties ranging from $460 to $681 per ton on Chinese titanium dioxide enterprises. India, which accounts for 10% of China’s total titanium dioxide exports, has reopened its doors to Chinese enterprises, restoring their price competitiveness in this key market.

Overseas News

In response to Japanese concerns that the China-Russia joint air strategic cruise threatens its national security, Ministry of National Defense Spokesperson Zhang Xiaogang stated that on December 9, the air forces of China and Russia conducted the 10th joint air strategic cruise over the East China Sea and western Pacific Ocean. This cruise is a scheduled item in the annual cooperation plan, demonstrating the two sides’ resolve and capability to jointly address regional security challenges and safeguard regional peace and stability.

China’s Consumer Price Index (CPI) rose 0.7% year-on-year, an increase of 0.5 percentage points from the previous month and the highest since March 2024. The expanded year-on-year growth was mainly driven by food prices turning from decline to increase. Core CPI, excluding food and energy prices, rose 1.2% year-on-year, maintaining growth above 1% for three consecutive months. CPI fell 0.1% month-on-month, mainly affected by seasonal declines in service prices.

On December 9, the United Nations Conference on Trade and Development (UNCTAD) released its year-end Global Trade Update report, showing that driven by trade in East Asia, Africa, and South-South cooperation, global trade will grow by approximately 7% (an increase of $2.2 trillion) in 2025, reaching a record $35 trillion. Despite factors such as geopolitical tensions, rising costs, and unbalanced global demand slowing trade growth, trade volumes continued to rise in the second half of 2025. The report pointed out that manufacturing (especially electronics) is the main engine of economic growth, while the energy and automotive sectors are relatively lagging. Global trade imbalances remain severe, geopolitics is reshaping trade flows, and the 2026 outlook is clouded by uncertainties.

Price Information:

The central parity rate of the RMB against the USD is set at 7.0753, up by 20 points; the previous trading day's central parity rate was 7.0773, the official closing price of the previous trading day was 7.0693, and the night session closed at 7.0633.

[Upstream raw material USD market prices]

CFR Northeast Asia is $745 per ton, and CFR Southeast Asia is $725 per ton.

The average FOB price of propylene in Northeast Asia is $715 per ton, and the average CFR price in China is $750 per ton.

The CFR price for refrigerated cargo in Northeast Asia is $558-560/ton for propane and $613-615/ton for butane.

The January CFR price of South China refrigerated cargoes is $582-592 per ton for propane and $572-582 per ton for butane.

The CIF price for frozen goods in Taiwan is $558-560 per ton for propane and $613-615 per ton for butane.

[LLDPE USD Market Price]

Film: $790-810/ton (CFR Huangpu);

Injection molding: $980/ton (CFR Huangpu);

[HDPE USD Market Price]

Film: $880-895/ton (CFR Huangpu);

Injection molding: 780 USD/ton (CFR Huangpu);

Hollow: USD 820-825/ton (CFR Huangpu);

Pipe material: USD 1000/ton (CFR Huangpu);

[LDPE USD Market Price]

Film: $990-1015/ton (CFR Huangpu)

Coating: $1050-1180/ton (CFR Qingdao).

[PP USD Market Price]

Injection molding: 785 USD/ton (CFR Huangpu);

Copolymers: $830-855/ton (CFR Nansha);

Membrane material: $970-985/ton (CFR Huangpu);

Transparent: $1065/ton (CFR Huangpu);

Pipes: USD 1,100/ton (CFR Shanghai).

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage