November Passenger Car Sales Top 20: Tesla Model Y/3 Sales Double, AITO M7 Re-enters Top Ten

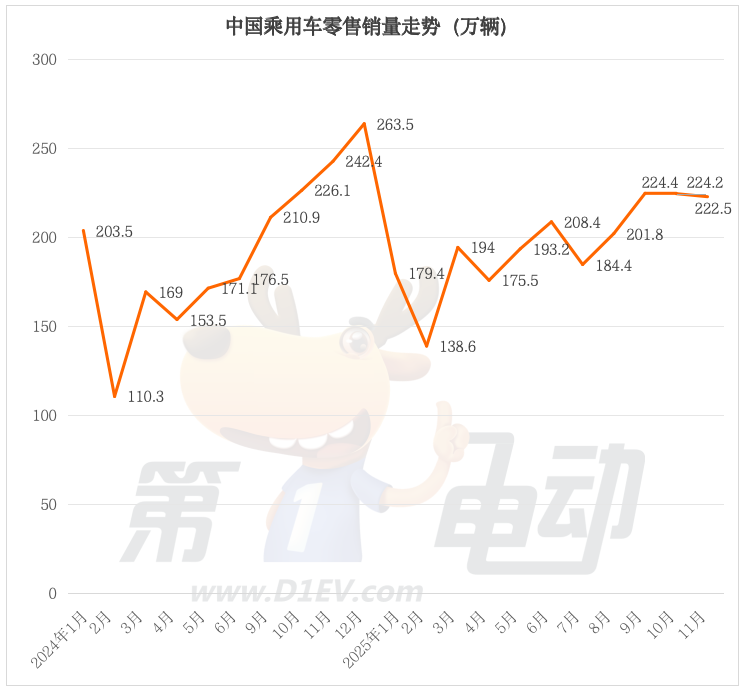

In November, China's passenger car retail market showed a divergent trend, with overall sales declining both year-on-year and month-on-month. According to data from the Passenger Car Association, the total retail volume of passenger cars reached 2.225 million units, a slight month-on-month decrease of 1.1% and an expanded year-on-year decline of 8.1%. This marks the second consecutive month of year-on-year decline in the market.

In stark contrast, the new energy passenger car market performed steadily, with retail sales reaching 1.321 million units, marking a 3% increase month-on-month and a 4.3% positive growth year-on-year. Overall, the core reason for the decline in the passenger car market is attributed to the drag from the fuel vehicle segment.

In the top 20 sales list of vehicle models, several models performed remarkably well, with a particularly notable rebound among leading electric vehicle models. Due to the low sales base in October and the large delivery of the rear-wheel drive long-range versions, the sales of Tesla Model Y and Model 3 doubled month-on-month in November, directly driving Tesla China's retail sales to soar over 180% month-on-month, successfully reversing the sluggish situation in October.

The list also features two new faces, the AITO M7 and the Binggo S, both making their debut in the top 20. The AITO M7, with a substantial number of new model deliveries, achieved a monthly sales figure of over 25,000 units, making a return to the top ten of the list. The Binggo S, launched only two months ago, surpassed 17,000 units in sales, initially showcasing its potential as a hot-selling model. In terms of year-on-year growth, the two models under Geely performed the best, with the Boyue L and Xingyuan both achieving a doubling in sales. Among them, the Geely Boyue L led the entire list with a remarkable year-on-year growth rate of 138.4%.

The competitive landscape of the top 20 brands is equally intriguing. BYD continues to hold the champion position, but it must be cautious as its monthly sales have decreased by 35% year-on-year, marking the fourth consecutive month of decline. However, BYD is continuously enhancing its product matrix through the layout of high-end brands like Fangcheng Leopard, building momentum for future market growth.

Wenjie and Ideal both returned to the rankings. Among them, Wenjie performed particularly well, successfully re-entering the TOP 10 with the continuous hot sales of its new models M7, M8, and M9. Ideal, on the other hand, relied on the stable sales of models like i6 and L6, achieving a month-on-month sales increase of 4.5%, surpassing Xiaopeng and once again entering the TOP 20. In contrast, Xiaopeng's sales in November saw a significant month-on-month decline of 15%, unfortunately dropping out of the rankings.

#01

Tesla's "Two Brothers" Double Surge

In November, the retail rankings saw a significant reshuffle among the top players, with new energy vehicles demonstrating strong market explosive power. Among the most remarkable market phenomena of the month was the "doubling surge of the Tesla brothers," while the Wenjie M7 successfully returned to the top ten rankings, leading to further changes in the competitive landscape of top models.

From the perspective of growth rate, the performance of car models this month shows a distinct divergence. Among them, the Tesla Model 3 achieved a remarkable month-on-month growth rate of 299.1%, becoming the fastest-growing model of the month, with sales reaching 26,011 units in November, a leap from 6,518 units in October. On August 12, Tesla launched the long-range rear-wheel-drive version of the Model 3, which has been officially referred to as the "highest range Model 3 ever," with a CLTC-rated range of 830 kilometers and a starting price of 269,500 yuan. Tesla's official website in China indicates that the expected delivery time for Model 3 orders is currently 4 to 6 weeks, meaning that orders are already scheduled into 2026.

However, it should be noted that despite the impressive month-on-month performance, the Model 3 has still declined by 10.0% year-on-year, reflecting the intense competition it faces from rivals like the Xpeng P7+ in the new energy mid-size car market.

The "brother model" Model Y also performed impressively, with sales reaching 47,132 units, ranking it second with a remarkable month-on-month increase of 141.9%. The success of the Tesla Model Y can be attributed to the launch of its long-range rear-wheel-drive version priced at 288,500 yuan in early November, which boasts a range of 821 kilometers. This is a significant improvement in cost-effectiveness compared to the previous long-range all-wheel-drive version, which required over 310,000 yuan. After the new version was launched, it quickly became the main sales driver, helping the Model Y double its sales in November.

In addition, in November, Tesla accurately seized the timing of the purchase tax incentive policy and executed a brilliant "combination punch." The company reminded consumers through various channels to "place orders promptly to ensure delivery within the year," capitalizing on their sensitivity to policy incentives and successfully stimulating their desire to purchase. At the same time, Tesla extended the delivery period for the Model Y to January-February next year, artificially creating a sense of urgency due to product scarcity. This "hunger marketing" tactic prompted many consumers who were initially hesitant to make decisive purchases.

#02

Wenjie M7 returns to the top ten, and Binggo S stands out.

The self-owned new energy models also performed outstandingly, with Hongguang MINIEV securing the top position with sales of 56,756 units. Despite a slight month-on-month decrease of 7.7%, it still achieved a high year-on-year growth of 63.2%, continuing to consolidate its dominant position in the micro pure electric market. Xiaomi YU7, as an emerging star in the car market, achieved sales of 33,729 units in November, with a slight month-on-month increase of 0.2%. Due to production capacity constraints, it could not achieve a greater breakthrough, but it has maintained a sales level of over 30,000 units for three consecutive months, with cumulative deliveries surpassing 500,000 units, entering the first tier of new energy sales.

Notably, the AITO Wenjie M7 has successfully returned to the top ten with a sales figure of 25,264 units, achieving a month-on-month growth of 57.2% and a year-on-year increase of 88.3%. This achievement is attributed to the comprehensive upgrade of the new Wenjie M7, which features the industry's first in-cabin laser vision solution and the iDVP electronic and electrical architecture, enabling OTA upgrades for all vehicle controllers. Additionally, the full coverage of both range-extended and pure electric versions accurately meets the multiple needs of family users for safety, intelligence, and endurance.

The Wuling Binggo S has started to stand out. On September 27, the Wuling Binggo S was officially launched with a price range of 66,800 to 79,800 yuan. The new car can be combined with a 3,000 yuan trade-in subsidy, making the effective price 63,800 to 76,800 yuan. As the third model in the Binggo family, the new vehicle is equipped with a drive motor that has a maximum power of 75 kW and offers optional CLTC range versions of 325 kilometers and 430 kilometers. Compared to the Binggo, it has a stronger sense of quality and better cost-performance ratio.

In terms of year-on-year growth, the Geely Boyue L leads the list with a high year-on-year increase of 138.4%, achieving sales of 31,348 units in November. As a veteran in the self-owned compact SUV market, the sales surge of the Boyue L is not coincidental. Its 2025 model has added a hybrid version equipped with a 1.5T plug-in hybrid system, offering an all-electric range of up to 120 kilometers, perfectly suited for both urban commuting and long-distance travel scenarios. At the same time, the intelligent configuration has been upgraded with a car system powered by the 8155 chip, supporting voice wake-up-free and multi-scenario custom modes, further highlighting its cost-effectiveness advantage.

Apart from the Boyue L, the Geely Xingyue follows closely with a year-on-year increase of 109.8%. The strong performance of these two models has become an important support for Geely to secure its market share amid the wave of transition to new energy.

#03

#03

BYD has seen a year-on-year decline for four consecutive months, while the Fangcheng Leopard has made its debut on the list.

In the passenger car retail rankings for November, BYD maintained its champion position with sales of 258,892 vehicles. However, it is important to note that the 35% year-on-year decline this time has put BYD in a situation of consecutive year-on-year sales declines for four months.

Sales decline of plug-in hybrid vehicles is the key factor dragging down overall performance. The Qin PLUS DM-i is in an upgrade cycle, causing consumers to hesitate, while brands like Leapmotor and Geely are diverting a large number of customers with competitive pricing in the hybrid sector. Additionally, price reductions and promotions of traditional fuel vehicles have further squeezed the market space for low-priced plug-in hybrid models. However, BYD is continuously improving its product matrix through the strategic positioning of high-end brands like Fangchengbao, thereby accumulating momentum for future growth.

Despite Tesla significantly boosting its sales with the Model Y and Model 3, achieving the highest month-on-month growth among the TOP 20 list and becoming a highlight in the November market, its year-on-year comparison still slightly decreased by 0.5% due to the base effect, ultimately ranking seventh.

At the same time, Chinese brands have performed impressively, with companies like AITO, Galaxy, Leapmotor, Xiaomi, and Fangchengbao all achieving significant year-on-year growth. Among them, BYD's high-end brand Fangchengbao stood out particularly, with sales reaching 35,289 units in November, marking a 314% year-on-year increase and entering the top 20 for the first time as one of the fastest-growing brands. Its core success lies in precisely positioning itself in the new "family-oriented off-road SUV" segment, balancing off-road performance with practical usability, and employing a "high-end but affordable" pricing strategy, successfully transitioning from the "niche off-road segment" to the "mainstream family SUV market."

AITO has returned to the TOP 10 list, further consolidating its market competitiveness, thanks to the continued strong sales of its three main models: the new M7, M8, and M9.

It is worth noting that thanks to the strong sales of models like the Ideal i6 and L6, Ideal's sales increased by 4.5% month-on-month, surpassing Xiaopeng and re-entering the TOP 20, while Xiaopeng's sales in November dropped significantly by 15%, causing it to fall off the list.

In stark contrast to the rapid progress of new energy brands, traditional fuel vehicle brands generally suffered setbacks in November. Among the joint venture brands, Honda and Chery both experienced year-on-year declines exceeding 30%. Brands such as Changan, Mercedes-Benz, and BMW also saw varying degrees of year-on-year declines, with Honda and BYD both facing a 35% drop, making them the two most significantly declining major brands, resulting in a further fall in their rankings outside the top ten.

Among independent traditional brands, Geely achieved contrarian growth with a year-on-year increase of 5%, supported significantly by the strong performance of its Galaxy brand. Hongqi also achieved a year-on-year growth of 1% thanks to stable product strength. Meanwhile, Wuling, as a representative of the entry-level market, maintained stable sales in November, remaining essentially unchanged compared to the same period last year.

The year-end sprint has officially begun, and the domestic car market is facing its most intense final battle of the year. Major car manufacturers are entering "wartime mode," gearing up to showcase their strategies—some are increasing product discounts, others are accelerating the delivery of new products, and some are optimizing channel service experiences, all in a concerted effort to make a final push towards their annual sales targets.

This battle concerning annual performance, market structure, and the future of the industry will mark the conclusion of this year's Chinese car market, and it is worth our continued attention.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories