Tencent Bets: Vascular Intervention "Little Giant" Tackles IPO

By the end of 2025, the capital market for medical devices is buzzing with activity, as multiple companies rush to pursue IPOs.

On December 24, the ChiNext IPO application of Guangdong Bomai Medical Technology Co., Ltd. (referred to as "Bomai Medical") was accepted by the Shenzhen Stock Exchange, with CICC acting as the sponsor. Bomai Medical is launching an impact on the capital market with a fundraising plan of 1.7 billion yuan.

This "little giant" in the vascular intervention sector, with a global presence and products sold in over 100 countries, has attracted top-tier institutions such as Tencent Investment, Hillhouse Capital, and IDG Capital, becoming another important exploration for domestic high-end medical devices to make a push into the capital market.

Prospectus Analysis: Current Status Portrait of Bomei Medical

According to information disclosed in the prospectus, Boma Medical is primarily focused on the research, production, and global sales of high-performance vascular interventional medical devices. The company specializes in providing interventional treatment solutions for complex vascular diseases and holds multiple credentials such as National High-Tech Enterprise, Specialized and New "Little Giant" Enterprise, and Manufacturing Single Champion Enterprise, with its technology and industry status officially recognized.

As of the date of signing the prospectus, the company has launched 7 globally original or uniquely innovative products; meanwhile, as the sole completion unit, the company was awarded the 2020 Guangdong ProvinceSecond Prize for Scientific and Technological ProgressIn addition, 12 products have been recognized as high-quality high-tech products in Guangdong Province, and more than 80 domestic and international invention patents have been granted, laying a solid foundation for continuous innovation.

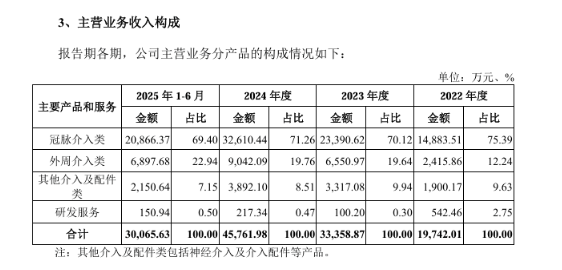

At the operational level, the company currently presents a pattern of "high growth coexisting with risks." The growth performance is impressive, with 2022 showing significant results.—The compound annual growth rate of revenue is expected to reach 48.98% in 2024, and the revenue in the first half of 2025 has already reached 300 million yuan, indicating strong growth momentum.

However, the risks and hidden dangers cannot be ignored. Not only is there pressure on the asset and operational ends, but also key risks such as the impact of centralized procurement policies, intensified market and technological competition, reliance on distributor channels, long research and development cycles, and uncertainty in approvals require heightened vigilance.

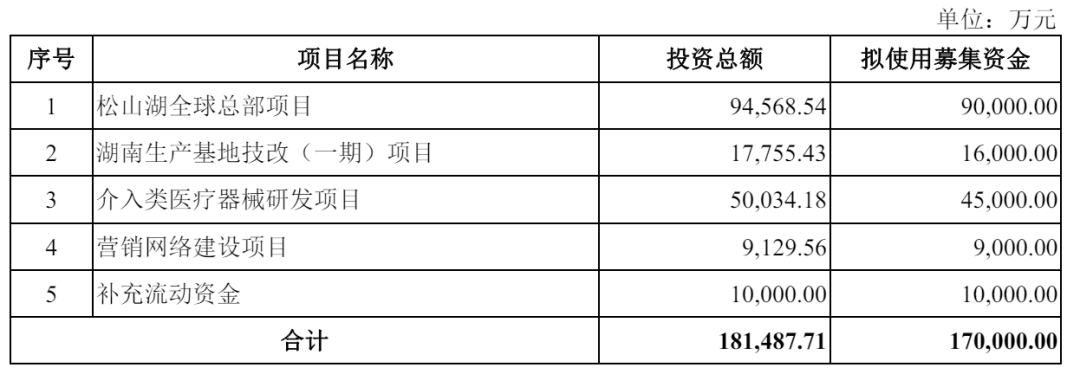

Fundraising Outlook: 1.7 Billion to Enhance Global Competitiveness

Based on the current development status, Bomei Medical's fundraising plan of 1.7 billion yuan targets "consolidating advantages + breaking through bottlenecks," forming five core investment directions and clearly outlining the future.—5-year development path.

9 billion yuan will be invested in the Songshan Lake Global Headquarters Project, focusing on creating a global research and development center and advanced manufacturing base. This will integrate resources from the existing five global R&D centers to enhance the efficiency of mass production of high-end products and address the current issue of insufficient coordination between production capacity and R&D.

RMB 160 million will be used for the technological renovation (Phase I) project of the Hunan production base, focusing on the large-scale production of key components, reducing reliance on external procurement, and enhancing the ability to independently control the industrial chain, in response to the current situation of low inventory turnover efficiency.

An investment of 450 million yuan will be dedicated to the research and development of interventional medical devices, focusing on breakthroughs in cutting-edge fields such as neurointervention and high-end peripheral vascular products, filling the gaps in the existing product line and creating new growth drivers.

9 million yuan and 100 million yuan will be used for marketing network construction and to supplement working capital respectively. The former will expand domestic and international service teams and regional offices to strengthen global market coverage, while the latter will be used to optimize cash flow structure and alleviate the debt repayment pressure brought about by a high asset-liability ratio.

From the perspective of industry opportunities, this fundraising layout coincides with the golden development period of the vascular interventional device industry.

Global population aging is intensifying, driving the continuous rise in the incidence of coronary heart disease and peripheral artery disease. The market size of coronary balloon dilatation catheters in China is expected to climb to 3.53 billion yuan by 2030, with a compound annual growth rate of 10.8% from 2024 to 2030. The market size is expected to reach 4.92 billion yuan by 2035, with a compound annual growth rate of 6.9% from 2030 to 2035.

At the policy level, the "14th Five-Year Plan" for the development of the medical equipment industry lists high-end vascular interventional devices as a key breakthrough direction. The fundraising efforts of Baomai Medical are highly aligned with industry trends, and it is expected to achieve rapid development by leveraging policy dividends and market expansion.

Product and Market: Global Breakthrough of Domestic Substitution

The product matrix is one of the core competencies of Boma Medical. It has now formed more than 50 product series covering five key areas: coronary intervention, peripheral intervention, neuro intervention, hemodialysis access, and interventional accessories. Nearly a thousand product combinations can meet diverse clinical needs, ranging from routine treatments to complex cases.

Among them, the coronary high-pressure cutting balloon catheter (RevoedgeTM PenetratorTM), peripheral vascular scoring balloon catheter (Tri-WedgeTM TrihornTM), and other 7 products are globally innovative or possess unique technologies, breaking the monopoly of international giants in the high-end balloon catheter field, with technical strength recognized by the industry.

In terms of market layout, the company has achieved dual results of "domestic leadership + global breakthroughs." Its products have been sold in over 100 countries and regions worldwide, serving thousands of hospitals and medical centers, and establishing a global marketing network with over 200 overseas and nearly 800 domestic distributors.

The core product, coronary balloon catheters, has maintained the leading export volume among Chinese brands for a long time and has successfully entered high-end markets such as the U.S. and Japan. According to Frost & Sullivan data, in 2024, the company ranked fourth in the Chinese coronary balloon dilation catheter market with a market share of 9.6% (the leading domestic brand) and ranked fifth in the Chinese peripheral balloon dilation catheter market with a share of 4.7%. Domestic brands account for over 50% of total production and sales, with exports accounting for over 75%, making it a core force in domestic substitution.

Finance and Capital: The Core Support of IPO

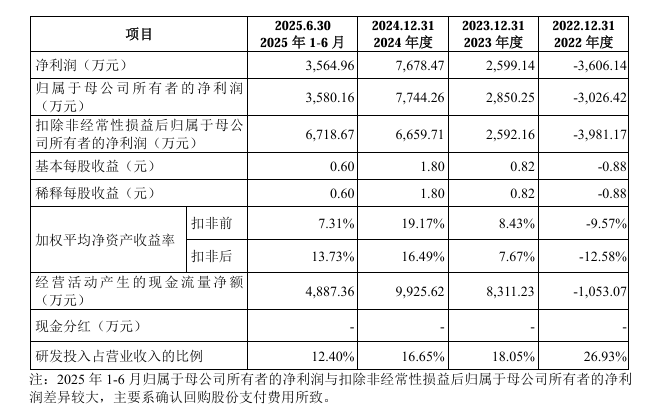

The financial data demonstrates the company's strong growth resilience, laying a foundation for the IPO process.

In the first half of 2025, the company's revenue and net profit reached 303 million yuan and 35.65 million yuan respectively, continuing a steady growth trend. The net cash flow from operating activities remained positive, amounting to 99.2562 million yuan in 2024, significantly higher than the net profit for the same period, reflecting a strong cash-generating ability from its main business.

The continuous support from the capital market has injected a strong impetus into the IPO process. Since the first round of financing was launched at the end of 2013, Boomay Medical has completed four rounds of financing, with capital recognition spanning the entire development cycle.

At the end of 2013 and the beginning of 2014, the Series A financing laid the foundation for initial research and development. The Series B financing in 2015 facilitated the expansion of the product pipeline. During the pandemic in 2020, the company completed a Series C financing of several hundred million yuan in just four months (led by Hillhouse Capital), demonstrating the market's strong recognition of its technological value. In June 2025, during the Series D financing, top institutions including IDG Capital joined in, and six months later, the company submitted its IPO application, showcasing the significant effect of capital-driven momentum.

It is worth noting that Tencent has invested in over 190 companies in the healthcare sector and obtained six medical device licenses. This investment is not accidental but an important step in deepening its layout in the high-end medical device track. In the future, it will bring technological synergy and ecosystem resource support to Boomai Medical beyond capital, further enhancing its post-IPO development potential.

Industry Insight: Breaking the Mold with Lessons from Single-Category Leaders

As a leading single-category company in the vascular intervention field, Bomei Medical's path to going public. Learn from the development history of similar enterprises.

The comeback story of the orthopedic single-category leader, Dabo Medical, offers considerable reference value: After its listing in 2017, Dabo Medical leveraged its core product technology advantages to become a heavily-invested "medical white horse" by institutions, with a peak market value of 19.8 billion yuan and stock price rising 9.2 times compared to the issue price. However, after the orthopedic consumables centralized procurement policy was implemented in 2021, the company's revenue plummeted 28.09% year-on-year, net profit dropped precipitously by 86.3%, and market value shrank by over 80%.

In the face of crisis, DaBo Medical achieved a breakthrough through three major strategies: securing market share by exchanging price for volume in the renewal of collective procurement, boosting the market share of domestic companies to 43%; expanding into non-orthopedic sectors such as minimally invasive surgery and dentistry to build diversified growth engines; and accelerating overseas expansion with products exported to more than 60 countries and regions.

Thanks to these measures, the company's revenue in 2024 increased by 39.29% year-on-year, and net profit surged by 505%. In the first three quarters of 2025, revenue reached 1.876 billion yuan and net profit attributable to shareholders was 425 million yuan, representing year-on-year growth of 22.69% and 77.03%, respectively, successfully emerging from the shadow of centralized procurement.

In contrast to other leading companies in the same category during the same period, Chunli Medical and Sanyou Medical were once deeply trapped in the dilemma of increasing revenue without increasing profits. However, since 2025, the differentiation has intensified. Companies that actively expand into new businesses and overseas markets have gradually shown signs of recovery, while those that stick to a single track continue to face pressure.

The differentiation trend in this industry provides a core insight for Boma Medical: after going public, it needs to proactively respond to changes in policies such as centralized procurement, and preemptively plan product portfolios and pricing strategies. It should avoid over-reliance on a single category and leverage fundraising to accelerate its expansion into new fields like neuro-intervention. Boma Medical should continue to strengthen its overseas advantages, further expand into high-end markets, and diversify risks associated with single markets.

Conclusion: The Capitalization Exploration of Domestic Medical Devices

With the backing of prominent investors like Tencent, Boma Medical's journey to the ChiNext is a microcosm of the domestic high-end medical device industry's upgrade through capital markets.

In the future, if BoMai Medical can effectively convert fundraising efficiency, continuously strengthen core technology barriers, balance the pace of domestic substitution and global expansion, and properly respond to industry competition and policy changes, it is expected to become a benchmark enterprise for Chinese medical devices "going global".

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories