Will the Microchannel Heat Exchanger Market Seize Opportunities Under the "Aluminum-for-Copper" Trend?

In 2025, global copper prices repeatedly reached historic highs, breaking the 100,000 yuan/ton mark for the first time. Due to China's scarcity of copper resources and high dependence on imports, while the aluminum industry possesses the world's leading resource and production capacity advantages, given the high copper prices... Amidst the rising trend, "aluminum replacing copper" has once again sparked high attention in the air conditioning industry.

In air conditioning systems, Heat exchangers (evaporators and condensers) are the components that consume the most copper. Currently, there are two types of aluminum heat exchangers: aluminum tube-and-fin heat exchangers and microchannel heat exchangers. Given that microchannel heat exchangers are widely used in markets such as North America, Southeast Asia, Japan, and South Korea, this article will outline for you:Aluminum replacing copper background. The current development status of global microchannel heat exchangers and the market opportunities they will face.

ChinaIOL

Global microchannel continues to grow, with high penetration rates in overseas markets.

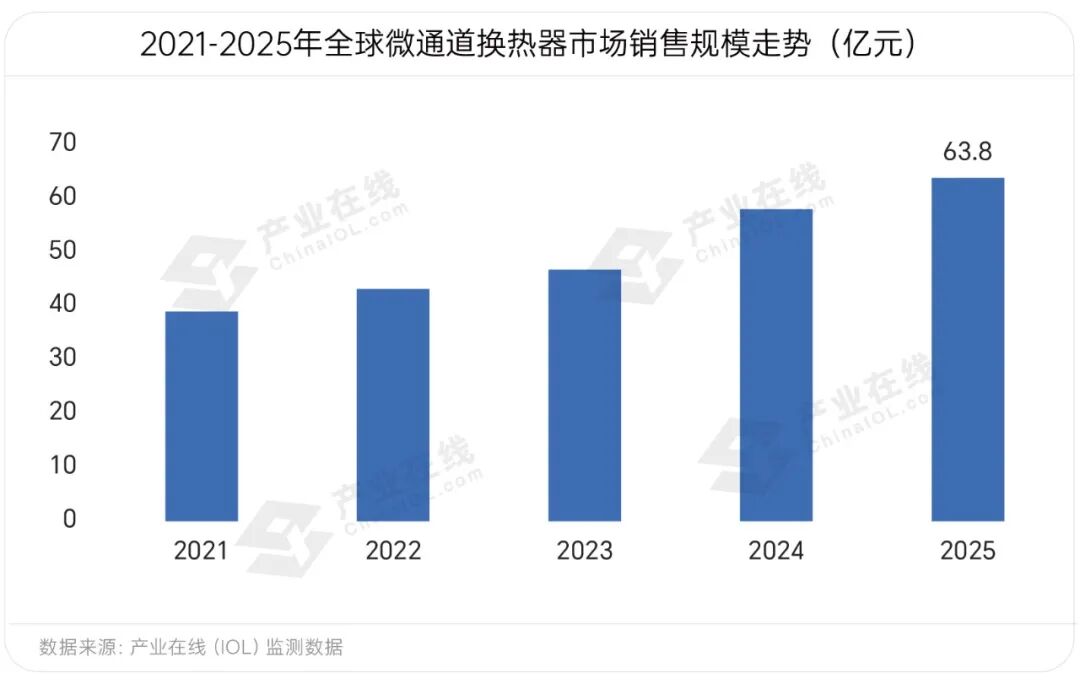

According to data from ChinaIOL, the global microchannel heat exchanger market is expanding due to policy support and increased downstream demand. The global sales volume is projected to reach 6.38 billion yuan in 2025, a year-on-year increase of 10.1%. On one hand, the North American market is further expanding demand for microchannel heat exchangers due to new energy efficiency standards, new refrigerant transitions, and consumer policy incentives, providing impetus for global scale growth. On the other hand, emerging application areas such as data centers and energy storage are rapidly expanding, especially the rapid growth of data centers, driving industry growth.

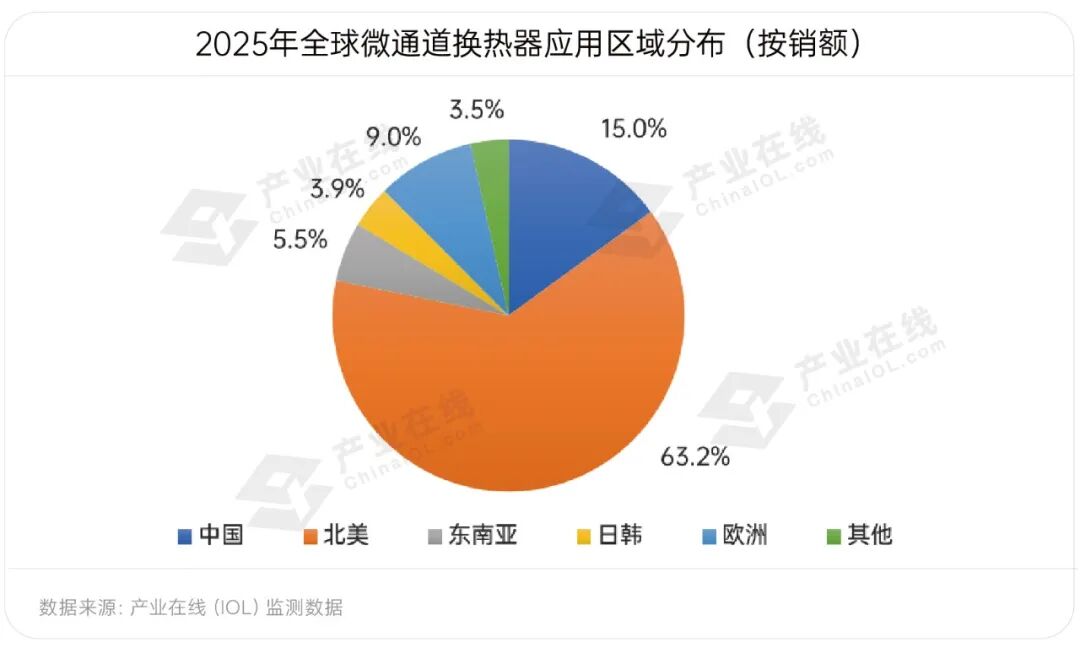

From the perspective of usage area distribution,Driven by factors such as climate environment, energy efficiency upgrades, and technological innovation, North America is the largest region for microchannel heat exchanger usage, accounting for 63.2%, and its share is continuously expanding. China is a major producer of air conditioners, but microchannel heat exchangers are mostly used in export models, currently accounting for 15.0% of sales. The combined share of other regions is 21.8%, of which The Southeast Asian market is primarily dominated by single-cooling air conditioners, making it relatively well-suited for microchannel applications. In recent years, the shift of industry capacity towards this region has, to some extent, driven the demand for microchannel heat exchangers.

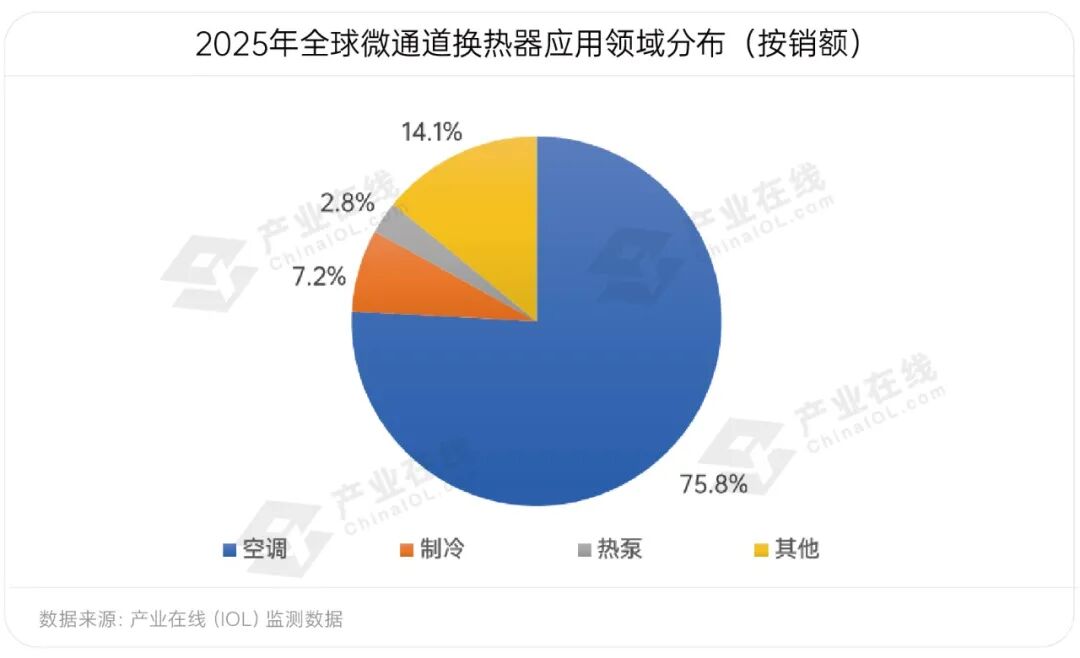

From the perspective of application field distribution, microchannel heat exchangers, with their advantages of high efficiency and energy saving, lightweight, and environmental protection, are utilized in air conditioning, heat pumps, refrigeration, and various emerging applications. The sector is showing a trend of differentiated development, with certain segments experiencing explosive growth. Among them, air conditioning accounts for more than three-quarters of the market share. According to statistics from ChinaIOL, air conditioning applications will represent approximately 75.5% of the market in 2025. Demand in overseas markets remains robust, with significant growth potential still existing in the United States and Southeast Asian markets, where cooling-only models are predominant.

Refrigeration applications account for about 7.5%, but due to the wide range of product sizes and high degree of customization in this field, R&D investment in microchannel technology is high, and the scale is relatively limited. Heat pump applications account for about 3%, among which the switch to microchannel heat exchangers in heat pump water heaters has achieved phased breakthroughs, and markets such as heat pump dryers also have potential. Other fields account for 14.0%, with rapid growth in applications such as data centers, energy storage, and new energy.A marked increase in proportion over the past two years. 。

ChinaIOL

Will the "Aluminum-for-Copper" Trend Bring Opportunities to the Chinese Market?

Although microchannel heat exchangers account for a high proportion in the air conditioning sector in North America, Japan, and Southeast Asian markets, their application in the domestic air conditioner market in China has not taken off due to various technical and market factors. This is despite China being a major producer of both air conditioners and aluminum.Therefore, the Chinese air conditioner market is the largest potential replacement market for microchannel heat exchangers, and whether large-scale replacement will occur in the future is a key focus for enterprises.

The slow progress of "aluminum replacing copper" in domestic air conditioners is attributable to multiple factors, including technological shortcomings, absence of national standards, lack of public and consumer trust, and an unconvincing cost advantage. These issues, coupled with divergent corporate strategies, have led to minimal progress in application exploration in recent years. Consequently, microchannel heat exchangers in the current Chinese market are primarily used in export models.

The "Aluminum for Copper" standard and corporate self-discipline convention issued in December 2025 mark a pivotal turning point for the development of microchannel heat exchangers in China's air conditioning market. In the short term, the replacement trend is expected to rapidly unfold in export models, continuously enhancing the market recognition and influence of microchannel heat exchangers. In the long term, microchannel heat exchangers will become a core support for cost reduction, supply security, and low-carbon development in China's air conditioning industry. Mainstream heat exchanger companies are also closely following market trends, actively deploying and reserving related technologies, striving to seize development opportunities in this industry transformation wave.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories