-

Robotic Dexterous Hands Enter Mass Production "Positioning War"! What Materials Are Used in the Future?

In 2025, humanoid robots ushered in their first window of industrialization. According to the latest statistics from the Ministry of Industry and Information Technology, the number of complete machine enterprises in China exceeded 140 in that year, w

Plastmatch -

Suv Wind Resistance Record Broken: What Does Zhijie R7's 0.217cd Mean?

On January 22, it was announced that the Luxeed R7 recently passed China Automotive Technology and Research Center's (CATARC) wind tunnel test, achieving a measured drag coefficient of 0.217. This figure sets a new world record for the lowest drag co

New Energy Vehicle Network -

Cancellation of Export Tax Rebates for Polyether: Where Should China Enterprises Go?

A recent announcement from the Ministry of Finance has brought a direct cost impact to the polyether industry, which relies heavily on exports. Starting from April 1, 2026, the VAT export tax rebate for various products, including polyether, wil

WELINK Oil -

Enjie Co. Receives 20 Million Yuan Government Subsidy

On December 22, Enjie Co., Ltd. (stock code: 002812) announced that its subsidiary, Jiangsu Enjie New Materials Technology Co., Ltd., recently received a subsidy of 20 million yuan from the Management Committee of the Jintan Economic Development Zone

Sina Finance -

Chinese Companies "Penetrate" European Supply Chain

One year after the EU imposed tariffs, Chinese car manufacturers saw a 93% increase in sales in Europe. Market analysis firms project that sales of Chinese car companies in the EU, the UK, and the European Free Trade Association countries are expecte

Gasgoo -

Japanese Brands Accelerate Embrace of Huawei's QianKun: China's Technology Becomes Lifeline for Joint Venture Automakers

The 2025 Guangzhou Auto Show serves as an industry barometer, gathering numerous new trends and dynamics in the automotive sector, reflecting the complex landscape of the car market in 2026. Consumers' car purchasing decisions are becoming increasing

CNMO Mobile China -

VAMA's "Yujian" Philosophy: The Car-Making Wisdom of a Leader in Hot-Formed Steel

In the wave of electrification and intelligentization, the automotive industry is undergoing profound transformation. As factors like range, smart cockpits, and intelligent driver assistance become focal points of competition, body materials, as the

Gasgoo -

Mercedes-Benz Introduces Autonomous Robot System to Reduce Costs and Increase Efficiency

According to foreign media reports, German car manufacturer Mercedes-Benz is accelerating the digitalization strategy of its van factory in Düsseldorf, Germany, and is introducing autonomous robotic systems aimed at reducing costs, increasing efficie

Gasgoo -

Tesla door handle malfunction traps child and is investigated: Design Chief Plans to Redesign Door Handle

According to reports from Fast Technology on September 18, U.S. authorities are investigating a potential issue with "electronic door handle failure" in certain Tesla electric vehicles, involving approximately 174,000 vehicles. Some car owners claime

Kuai Technology -

Researchers Develop Novel Aluminum Alloy to Achieve High Ductility

Most aluminum alloys produced by additive manufacturing (AM) technologies exhibit very limited ductility in the final products, which may lead to the necessity of using more expensive and heavier alternative materials in applications such as automoti

Cheyun.com -

Changshu Automotive Interiors Expands to Spain with Smart Cockpit Layout, Spotlight on Key Applications of Plastic Materials

Special Plastic Vision, August 4 – Changshu Automotive Trim announced over the weekend that, based on strategic planning and the needs of overseas business development,To establish a wholly-owned subsidiary, "Changshu Automotive Trim (Spain) Intellig

Plastmatch -

All-New XPeng P7 With Over 3m Wheelbase to Debut on August 6

Recently, Chezhinet learned from XPeng Motors that the all-new XPeng P7 will be officially unveiled on August 6. The new model is positioned as a mid-size car, with a wheelbase exceeding 3 meters, offering a more outstanding interior space. In terms

Cheyun.com -

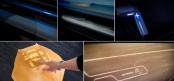

Do you know the 7 common light-transmitting materials used in car interiors and their applications?

With the continuous development of automotive intelligent surface technology, the application of translucent materials is gaining increasing attention from enterprises across the industry chain. This article examines the seven common translucent mate

CMF Design Legion Number -

In-Car Display Research: Dashboards Continue to Disappear, Rear Entertainment Screens Double, and Five-Screen Configurations Enter the Market

Zuo Si Auto Research Releases2025 Automotive Display and Central Control Instrument Industry Research Report》。 In addition to cockpit interaction, in-vehicle display is another important carrier of intelligent cockpits. In recent years, the intel

ZoThink Auto Research

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories