-

Another Johnson & Johnson Veteran Joins! Major Personnel Change at Medical Device Giant

On September 17, 2025, according to Reuters, diabetes giant Insulet announced a major personnel appointment:Flavia Pease, former Vice President and Group Chief Financial Officer of Johnson & Johnson Medical Devices, will be appointed as the com

Medical Device Business Review -

Overseas Highlights: PPG Establishes New Aerospace Coatings Plant in the US, Yizumi Turkey Company Officially Opens! Pepsi Adjusts Plastic Packaging Goals

News Headlines: Raw Materials News - $380 Million! PPG to Build New Aerospace Coatings Plant in the United States Automotive News - FF Officially Receives Factory and Operation Center in Ras Al Khaimah, UAE Packaging News-PepsiCo moves its sust

Specialized Plastic World -

1.2 Billion Yuan! Japanese Machinery Company Acquires German Plant from WuXi Biologics

On May 14, Japanese medical device manufacturer Terumo announced that it has acquired its Leverkusen plant in Germany from WuXi Biologics for 150 million euros (approximately 1.2 billion yuan). The plant, originally a Bayer asset, was purchased by Wu

MedTrend Medical Trends -

Siemens Healthineers: Varian to Relocate Part of Production from Mexico to the United States

Siemens Healthineers has just announced plans to move part of Varian's manufacturing operations from Mexico to the United States. The company plans to transfer Varian's manufacturing operations in Baja California, Mexico, to Palo Al

Medical Device Home -

Medical Device Giant Restructures Again to Save Itself as Stock Plummets 67%

Diabetes giant, reorganization twice in less than half a year, terminates important product line! 01 Global Diabetes Giant: Will be further reorganized! Recently (May 9, 2025), according to foreign media reports, the g

Medical Device Business Review -

Medical Device Giants Maintain Strong M&A Enthusiasm: Key Sectors to Watch

Despite the significant uncertainty brought about by the current tariff issues, the industry still hopes to see more merger and acquisition transactions in fields such as orthopedics and interventional cardiology; major merger targets are expected t

Sina Finance -

Billions Lost: How Much Longer Can Medical Device Profit Margins Withstand the Impact of Tariffs?

Recently, Abbott released its Q1 2025 earnings report, with total revenue of $10.36 billion, a year-on-year increase of 4.0%. However, behind this seemingly steady report lie hidden concerns. The company's CEO, Robert Ford, warned investors during th

Medical Device Innovation Network -

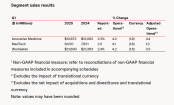

Abbott and Johnson & Johnson: Global Medical Device Giants' Robust Performance and Strategies Amid Tariff Pressures

In April 2025, two of the world's leading medical device giants, Johnson & Johnson and Abbott, announced their financial reports for the first quarter. Although both companies revealed the impact of tariffs on their finances in the repo

Frontiers of High-Value Medical Consumables -

Over 300 Employees Laid Off! Is Meina Unable to Cope?

On April 16, 2025, Illumina announced through an internal email a global workforce reduction of approximately 3.5% to advance its $100 million cost-cutting target. Based on the employee count of 8,970 at the end of 2024, this layoff affects over 300

Medical Device Innovation Network -

Abbott May Lose $2.2 Billion This Year, with Major Pressure in U.S. and China Markets

01 Abbott CEO: Tariff shock could reach hundreds of millions of dollars. Yesterday (April 16, 2025), global medical device giant Abbott revealed in a earnings call that the company expects the tariff policies this year to impact the c

Medical Device Business Review -

Johnson & Johnson Medical Faces Potential Loss of Nearly $3 Billion, 70% From Chinese Market

Yesterday (April 15, 2025), executives at Johnson & Johnson stated in the company’s first-quarter earnings report that they expect the anticipated increase in global tariffs to result in a $400 million (approximately RMB 3 billion) financial h

Medical Device Business Review -

Haier Biomedical has been awarded the world's first EU MDR certificate for medical low-temperature storage equipment, accelerating its international expansion.

On April 8th, at the 91st China International Medical Equipment (Spring) Expo (CMEF), the international independent third-party testing, inspection, and certification organization TÜV Rheinland Greater China (referred to as "TÜV Rheinland") awarded Y

Securities Market Weekly -

14 devices have entered the "Innovation Channel"!

Recently, the Center for Medical Device Evaluation of the National Medical Products Administration released the review result announcement of the special review application for innovative medical devices (No. 3, 2025), proposing to agree14 modelsMedi

Pharmaceutical and Medical Device Intelligence Data -

Major Move! Orthopedic Giant Completes Sale of This Business

According to foreign media reports, Stryker, a global orthopedic giant, announced yesterday (April 1) that it has completed the sale of its U.S. spinal implants business to Viscogliosi Brothers, LLC, a family investment company focused on the neuromu

Pharmaceutical Intelligence Medical Device Data -

Peijia Medical collaborates with DSM-Finland to achieve results using UHMWPE and TPU in polymer heart valves.

On April 1, 2025, Peijia Medical held a strategic innovation cooperation signing ceremony and press conference at its global headquarters, announcing a collaboration with the biomedical division of DSM-Firmenich, an innovator in nutrition, health, an

Peijia Medical Technology -

Mindray announces its latest plan

The export of medical devices, centralized procurement, and AI healthcare are becoming significant development trends in the medical device industry. What is the future direction? Mindray has made its latest judgment.01The international market will e

Saibolan Equipment -

The two major domestic enterprises in cardiovascular interventional therapy and artificial heart field have joined in opening ceremony!

On the morning of March 28, the joint opening ceremony of Zhejiang Nuvalve Medical Technology Co., Ltd. and Zhejiang Huancheng Medical Technology Co., Ltd., two leading scientific and technological innovation enterprises in the field of domestic card

Medical polymer materials -

Strong Alliance to Jointly Advance the Commercialization of Bioengineered Corneas

On March 27, Xi'an Eyedeal Medical Technology Co., Ltd. (referred to as Eyedeal Medical) signed a cooperation agreement with the U.S.-based Pantheon Vision to jointly advance the production and commercialization of bioengineered corneas, aiming to pr

Medical polymer materials -

Medical Device Giant: Lays Off 300 Employees, To Close Plant in April Next Year!

The consecutive closure of factories and withdrawal by giants have gradually made the "tax haven" a thing of the past.01Cardinal Health lays off 300 employees. 43-year-old factory to be closed downRecently, according to the Irish Indep

Medical Device Business Review -

U.S. Department of Health cuts 10,000 jobs and streamlines departments; first automated endoscope cleaning system approved by FDA | Weekly Overseas Medical Device News

【2025W14-Vol.51】The Trump administration plans to cut tens of thousands of employees from the Department of Health and Human Services.On March 27, Robert F. Kennedy, the newly appointed U.S. Secretary of Health and Human Services (HHS), announced tha

Yitong News Agency

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories