-

Medical Device Giants Maintain Strong M&A Enthusiasm: Key Sectors to Watch

Despite the significant uncertainty brought about by the current tariff issues, the industry still hopes to see more merger and acquisition transactions in fields such as orthopedics and interventional cardiology; major merger targets are expected t

Sina Finance -

Billions Lost: How Much Longer Can Medical Device Profit Margins Withstand the Impact of Tariffs?

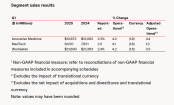

Recently, Abbott released its Q1 2025 earnings report, with total revenue of $10.36 billion, a year-on-year increase of 4.0%. However, behind this seemingly steady report lie hidden concerns. The company's CEO, Robert Ford, warned investors during th

Medical Device Innovation Network -

Abbott and Johnson & Johnson: Global Medical Device Giants' Robust Performance and Strategies Amid Tariff Pressures

In April 2025, two of the world's leading medical device giants, Johnson & Johnson and Abbott, announced their financial reports for the first quarter. Although both companies revealed the impact of tariffs on their finances in the repo

Frontiers of High-Value Medical Consumables -

Predicting the Trends in Medical Consumables Centralized Procurement in 2025

This year's Government Work Report explicitly proposed to "optimize the centralized procurement policy, strengthen quality assessment and supervision." In 2025, China's centralized bulk procurement will enter a critical period of consolidation and en

Sina Finance -

Overview of the low-value medical consumables industry: The market size is expected to continue rising, demonstrating broad prospects for development.

Content Summary:Low-value medical consumables primarily refer to disposable sanitary materials frequently used by medical institutions during healthcare services. With the continuous improvement of China's medical insurance system and the rising livi

Zhi Yan Consulting -

India Medical Device Industry Development Report (2024)

In 2024, driven by both regulatory policies and industry demand, India's medical device market continued to develop, with a total annual registration volume of 28,405, marking a 12.46% increase compared to 2023. However, the monthly growth rates show

YaoZhi Medical Device Data -

Official document issued: Accelerated payment for consumables

The Terminator for Consumables Payment Dilemmas is Here?01Many places across the countryThe healthcare insurance fund shifts from "post-payment" to "pre-payment".On March 24, the Zhejiang Provincial Medical Insurance Bureau issued the "Notice of the

Cyblean Equipment -

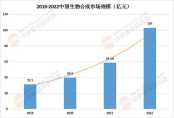

Development Status and Market Scale Analysis of the Biosynthesis Industry in 2025, along with Competitive Landscape Analysis

The biosynthesis industry, as an emerging sector in the field of life sciences in the 21st century, is leading a new round of biotechnology revolution with its unique technological advantages and broad application prospects. In recent years, with con

CCID Network -

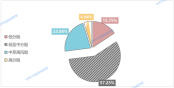

Medical-grade high-end chemical materials: current situation and future

Medical-grade chemical materials come in many types, primarily可分为高分子、金属、无机非金属及复合材料, and they are mainly applied in areas such as medical devices, drug carriers, implant equipment, and more. Note: The phrase "可分为高分子、金属、无机非金属及复合材料" is directly translat

Chemical Engineering Society -

Analysis of the Competitive Landscape and Development Trends of China's Biomedical Materials Industry in 2025: Acceleration of Domestic Substitution Process

Industry Overview Biomaterials, also known as biomedical materials, refer to functional materials used for medical purposes, which come into contact with living systems and interact with them. These materials can diagnose, treat, replace, or repair h

Zhiyan Consulting -

A large number of hospitals are transforming, and these medical devices are becoming a trend.

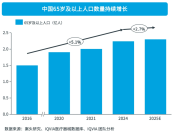

The new era of the silver-haired health industry has arrived.01Support a number of hospitals in transforming into rehabilitation hospitals and nursing homes.Strengthen the application of intelligent medical devices for the elderlyRecently, the Depart

Sai Bai Yun Medical Device -

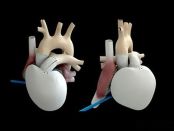

Trends in Domestic Cardiovascular Devices: These Trends Are Exploding

China's cardiovascular patients have surpassed 300 million, with over 10 million new cases each year. The urgent demand from this influx of patients has driven the market scale for implantable interventional devices to soar, growing from over 30 bill

Saibolun Equipment -

Nine Major Adjustments in the Medical Device Industry by 2025, Unveiling Core Transformations

In 2025, the medical device industry is steadily embarking on a journey of continuous transformation and upgrading. This year, a series of significant changes are poised to unfold, signaling that the industry will enter a brand new stage of developme

Frontier of High-Value Medical Consumables -

Pharmaceutical and Healthcare Industry Exceeds Trillion! Beijing Quietly Becomes the National Leader

If Beijing were personified, it would probably be an engineer wearing a black down jacket and a plaid shirt, who doesn't like to be in the spotlight, isn't good at promoting itself, and is even a bit wooden. But if you pull him down to have a chat, y

Siyu MedTech -

A Decade of Breakthroughs! Domestic Medical Devices Reach Nearly 70% Substitution Rate, Reshaping the Global Landscape

Domestic substitution, in the development of medical devices in our country in recent years, this topic has remained a hot topic, and it is also a long-term strategic direction for many细分领域. 似乎最后一部分没有完全翻译。让我继续完成整个句子的翻译。Domestic substitution, in the d

Medical Device Innovation Network -

Trump's tariff policies hit the medical technology industry, potentially increasing supply chain costs by a hundredfold!

The capricious tariff policies of the Trump administration are keeping the manufacturing sector on edge. Previously, we have extensively covered how the automotive industry and its supply chains in Mexico and Canada would respond if the tariff threat

Specialized Plastic Compilation -

Deep Analysis of China's Medical Device Industry in 2025: Transformation in the Medical Device Sector, How Should We Position Ourselves?

introductionIn recent years, China's medical device industry has experienced a transition from rapid growth to a rational adjustment period under the multiple drivers of policy, technology, and market demand. As the aging population deepens, medical

Meiqiao Medical Innovation -

Overview and Analysis Report on the Development and Market Competition Landscape of China's Pharmaceutical Plastic Packaging Industry in 2025

Pharmaceutical packaging mainly refers to the packaging of drug formulations, that is, the packaging and containers that come into direct contact with the drugs. Pharmaceutical packaging is an indispensable part of drugs, running through the entire p

Zhiyan Consulting -

Industry Research | Application Prospects of PAEK Materials (PEKK, PEEK) in the Medical Field

Material Innovation: Performance Breakthrough of PAEKPAEK (Polyaryletherketone) as the fourth-generation medical polymer material, achieves three core breakthroughs through unique molecular design:Biomechanical adaptability: 3-4 GPa elastic modulus f

Advanced Medical Materials -

Aesthetic medicine continues to return to serious medical practice, with "compliance" becoming the key term for the development of new materials in the aesthetics industry.

In recent years, while the medical aesthetics industry has been rapidly developing, it has also undergone profound changes and transformations. With the improvement of the regulatory system and the enhancement of consumer awareness, medical aesthetic

NBD Web

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories